A demat account or book entry is a type of online portfolio that holds customer shares and other securities. It delegated the need to hold and trade in physical units. Demat trading was introduced in India on the year of 1996 by NSE transactions. According to SEBI regulations, all listed company shares and bonds must be deregulated for transactions to take place on any stock exchange from 31 March 2019. The Demat account is used to hold shares and securities in electronic (deregulated) form. These accounts can also be used to create a portfolio of bonds, ETFs, mutual funds and similar stock market equity securities.

An investor may choose to open a debited account in one of the following types: -

Customers with Demat accounts must open a trading account in order to buy or sell securities from the stock exchange. Although the relevant depositors and depository participants regulate Demat accounts, the trading account is governed by the regulations regulated by SEBI.

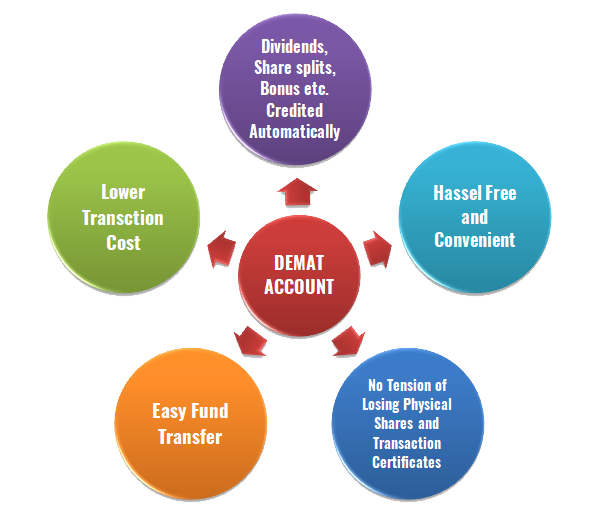

Investors who choose to open a Demat account can enjoy several benefits. Here are below most common benefits. Demat accounts exclude the risk of damage, forgery, misappropriation or theft of physical shares. The electronic system is also much simpler and can be completed in a matter of hours. It eliminated many laborious operations, and thanks to the whole process efficiently and saves time. Demat accounts have the advantage of remote access provided that individuals are registered for the relevant financial institution in a clean banking service. To facilitate the electronic transfer of funds, investors can merge bank accounts with deregulated accounts. Customers can take advantage of the nomination facility by opening an online Demat account. Account holders with a specific unit of securities in their portfolio can choose to freeze their accounts for a set period. This can be useful if you want to avoid any unnecessary transactions with your Demat account.

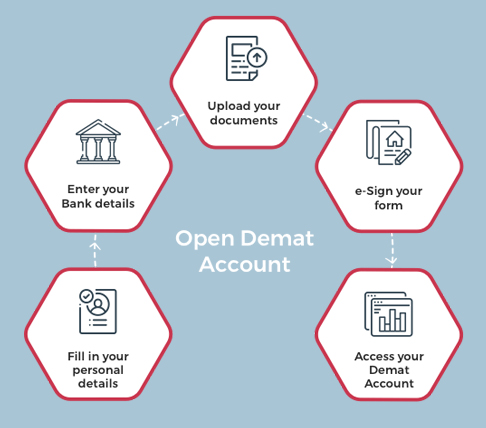

Any investor can open deregulated accounts only by registering with their preferred intermediary. Investors will be required to complete and submit an application form, together with some basic documentation (relating to receipt, identification and address proof). After submitting the same, the personal verification process will begin. Upon successful completion, investors will receive their unique client ID and account number. This can be used to link to a trading account and to buy or sell stocks and shares and to access a personal database online. Investors who have completed the process of opening a Demat account online will receive a letter from the relevant depositor containing all the details of their Demat account number. The account number issued by the CDSL has a 16-digit numeric value, while the NSDL issues a 16-digit numeric code preceded by "IN".

Investors also receive a DP ID or a depositor ID from their preferred intermediary or other financial institution. The DP ID is part of the number one account, because the first eight digit value of the account number is marked with this ID. Depository participants and depositors use this information when an investor transfers actual shares to a Demat, transfers shares from one Demat account to another, or transfers funds from a Demat account to a bank account.

Currently, all shares or certificates of security issued after March 31, 2019 are held in deregulated accounts to comply with latest SEBI rules. Investors can also transfer shares from one Demat account to another; this process is usually available when switching from one intermediary to another. Investors can also choose to transfer shares if they want to merge multiple portfolios into one account. As this process does not initiate any ownership transfer, the merchant account does not play a role in these transfers. Investors are also not responsible for any tax consequences.

Deregulation refers to the process of digitizing physical stocks and bond certificates in one of India's two stores. Reassignment refers to the process of converting electronic certificates to physical ones. Investors choose to refinance to avoid maintenance fees for Demat accounts that hold a minimum number of shares. Investors can contact the Deposit Participant with the Remat application form to convert their securities into physical certificates. In this case, each unit will provide the registrar and transfer agent (RTA) with a unique identification number to facilitate the conversion process.

While any investor can open a Demat account for free, certain fees are charged from that account to ensure its smooth operation. Each brokerage firm (including banks) has its own unique brokerage fees. Here are some of them -

Demat accounts play a vital role in investing in stock markets, as they are one of the most common methods of investing in stock markets. However, in recent times, many online platforms have provided the advantages of trading online without such accounts.

Q1. Who can open a Demat account?

Answers - Any Indian resident or non-resident can open a Demat account. Demat accounts can also be issued in the name of minors, as long as they are monitored by their legal representative.

Q2. Can Demat accounts be opened together?

Answers - Yes, it is possible to open a joint Demat account. A maximum of 3 account holders are available for one account, including the lead and two joint account holders.

Q3. Do you need a Demat account to apply for an IPO?

Answers - No, investors can ask for IPO shares and get them in physical form. However, it is best to apply for an IPO in a deregulated form, as the issued shares can only be traded online.

Q4. Is a Demat account required to use a systematic investment plan?

Answers - No, Demat accounts are mainly used for online stock transactions. Any investor in mutual funds, including SIPs, can be made directly by the preferred investor or financial institution.