IFSC stands for Indian Financial System Code. The IFSC code is a unique 11-digit number that is a combination of letters and numbers. NEFT we need to transfer funds online, IMPS and RTGS are also the same mode of transactions. This code is usually found on the checkbook which is provided by the bank. You can also get it on the front of the account holder's passbook. The IFSC code for each branch of the bank is provided by the Reserve Bank of India. The transfer of funds through the NEFT, IMPS and RTGS programs cannot be initiated without a valid IFSC code. The 11-digit IFSC code usually has no changes or updates. Bank Negara India recently amended the Code of Indian Financial Systems across its branches after merging with five affiliated banks and one other bank.

The following points let us the importance of this code.

The IFSC code contains the first four letters of the alphabet indicating the name of the bank. Therefore, the code for each of the same bank branches starts with the same four letters. The fifth character is zero. The remaining six characters are numbers or numbers that indicate the extension code. This is also the part that makes IFS code unique.

The transfer of electronic funds in India is facilitated by an alphanumeric code called the Indian Financial System Code (IFSC or IFSC Code). This code only recognizes all bank branches that participate in two major clearing and payment systems in India, namely National Electronic Bank Transfer (NEFT) and Real Time Gross Settlement (RTGS). IFSC code is an 11 digit code provided by the Indian Reserve (RBI). The first part of the code having four letters which is representing the bank. The next character is zero, reserved for future use. Branch identification codes are the last 6 characters.

Bank Negara India (IFS) (SBI) begins with the letter "PNB". Since there are many banks with many branches, you can find banks with IFSC codes that are part of the transaction. IFS codes are required when performing payment transactions, including RTGS and NEFT transfers. Like PNB, the IFSC code for branches in Sector 31 is Noida, PNBN0011569.

Finding IFSC is easy. If you have an account at any bank branch, you will be automatically notified of the IFSC printed on the passbook. However, if you want to know the code without creating an account, you can do it online. There is an official website that can be used as an IFSC code finder in India.

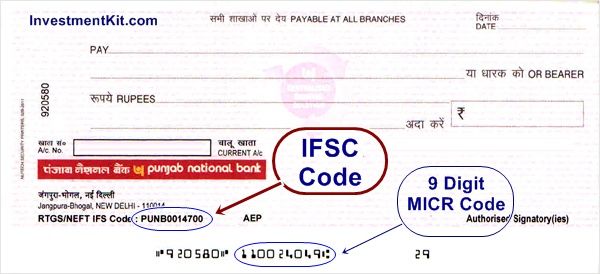

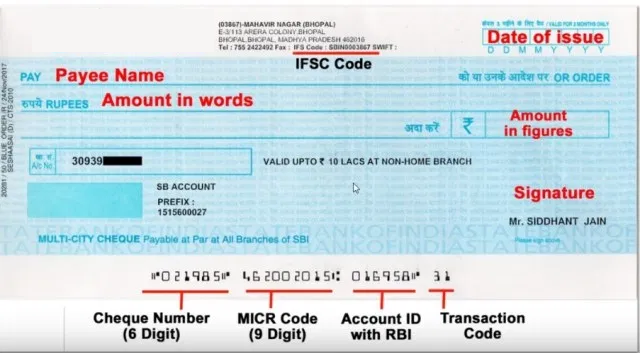

The IFSC, abbreviated to Indian Financial System Code, is an 11-digit alphanumeric code used to identify branches of banks involved in various electronic money transactions, such as NEFT or RTGS. You can find one IFSC code in its bank passbook or checkbook. The image below will help you better understand

IFSC search at any bank branch can be found on the bank's official website or at the emergency number.

For instance, if you want to know HDFC bank South Delhi branch code:

The first 3 digits of the code indicate the city code, the next 3 digits (middle) this indicate the specific bank code, and the last 3 digits tell the branch code. You can easily get the MICR number at the bottom of the bushes, printed next to the control number (right).

Definition: MICR stands for Magnetic Ink Character Recognition and is a 9-digit code that identifies the branches of banks participating in the ECS (Electronic Clearing System). The MICR code is necessary if you fill in various financial forms, such as SIP forms, etc., because it helps to remove the check more quickly.

The first 3 digits of the code indicate the city code, the next 3 digits (middle) indicate the bank code, and the last 3 digits represent the branch code. The MICR number can be found at the bottom of the checklist and printed next to the check number (right).

Since monetary transactions are not limited to financial institutions such as banks, thorough verification is required before transactions can be made. To make the process faster, easier and more automated, banks and other financial institutions rely on certain codes. These codes, namely the MICR and IFSC, play an important role in verifying the validity of the transaction. However, there is a difference between using these two codes.

| IFSC Code | MICR Code |

|---|---|

| It is used to facilitate electronic money transfer between the banks in India. | MICR code is initiated to make cheque processing simpler and faster. |

| IFSC is an 11-digit alpha-numeric code | MICR is a 9-digit code |

| The first four characters indicate the name of the bank. | The first three digits represent the city code where the bank branch is located. |

| Last 6 digits represent the bank location | Last three digits indicate the bank branch code. |

| Offline Method | Online Via Internet Banking |

|---|---|

| 1. You can check this on the first page of the checkbook | 1. Log in to the Bank of India website |

| 2. If you have an SBI bank account, the CIF number can be listed on your bank's passbook | 2. Select an account statement option and enter the dates |

| 3. You can also visit the nearest branch and find out your CIF number by entering your bank account number | 3. Select "view" |

| 4. You can also call their customer service number and request the same | 4. Click the "Go" button |

| 5. You can also get it through SMS services | 5. You'll be taken to the Account Summary page, where you can check your CIF, MICR, and IFSC code. |

| 6. You can check the same when viewing PAN details and nomination details | 6. You can also check this via the SBI Anywhere App |

Third Party Recipient Registration Procedure:

Each bank in India has its own policy of transferring funds by third parties. However, the method of transferring funds by third parties remains the same for each bank, except that they are slightly different.

Let's take a look at the third party recipient registration process.

There is no denying the fact that almost all of us rely on online payment methods, and you are certainly no exception. This online trend supports a number of possibilities - thanks to the digitization of money transactions. The benefits of online funds transfer are definitely making our lives easier. Almost every other bank provides more payment options, such as instant payment services (IMPS), domestic electronic funds transfers (NEFT), real-time gross settlement (RTGS), etc. Based on various parameters such as transfer rate, transaction value, service availability, etc., each of the above payment methods offers different features and flexibility. Although these payment methods have their advantages, they still have a wide range of flexibility and convenience for customers.

National Electronic Bank Transfer (NEFT) is one of the most secure method of transferring funds online from one bank to another bank. NEFT is based on a deferred agreement, which means that the money is transferred to a different group (group). There are 12 sets of business day payments (Monday to Friday) and six sets of business day settlements Saturday (Monday to Friday) from 8:00 am to 13:00 between 8:00 am and 7:00 pm. While there is no limit to the amount that can be transferred through the NEFT system, some banks have set limits. For example, SBI most oldest (National Bank of India) has set a limit of Rs 10 Lakh for the NEFT transfer amount in its retail banking capability.

1. Your bank branch must be activated for NEFT first. You can check and confirm it on the Reserve Bank of India (RBI) website.

2. Complete the registration process for your network banking account by creating a username and password. However, your mobile phone number must be registered at your bank to complete your registration in the network banking sector.

3.You then need to add the recipient to your account to whom you want to transfer the money. You need the name of the recipient, the bank account number and the IFSC (Indian Financial System Code) of your bank branch. You can get IFSC either in your account statement or in your checklist.

4.Once the beneficiary has been successfully added, there may be time allotted (by the bank) to transfer funds to additional recipients. For example, SBI also has the waiting time of 4 hours.

5.After logging in to your net bank account, go to the 'Fund Transfer' section, select the name of the specific recipient you want to transfer funds to, and make an OTP transfer (password only once) to your registered mobile phone number.

6. The amount will be transferred to the beneficiary according to the following settlement schedule.

NEFT costs in the range of 2.50 to 25 R (+ service tax) depending on the amount transferred to the recipient.

There are also restrictions on NEFT transactions, for example, it is not possible to transfer funds every time you like. This service is only available on weekdays and during bank business hours. You will not able to avail this service on weekends and holidays.

1.RTGS transfers are intended for transactions with high value funds. The minimum amount that can be transferred via RTGS is Rs 2 Lakh. The maximum transfer limit is unlimited. Because this transfer takes place in real time, the transferred person will receive this amount in about 30 minutes.

2. The RTGS service is open on weekdays from 9:00 to 16:30 and on Saturdays it's timing is 9:00 to 14:00.

3.The procedure for using the RTGS service is the same as for the NEFT procedure. All you need to do is make sure that both your bank account and the payee's account have RTGS enabled and that you have the IFSC code of your bank branch.

4. RTGS is slightly more expensive than NEFT, with a transfer of Rs2 Lakh-Rs 5 Lakh it can cost 30 Rs, while transactions exceeding Rs Lakh can cost Rs 55.

The verification process for a Personal loan involves the following key steps:

1. IMPS is an example of financing service and operates 24 * 7. It can be used 365 days a year to transfer funds to another bank account. This service was introduced in 2010 by National Payments Corporation in India.

2. You do not need to register specifically for IMPS - after online logging to your bank account, you will be able to transfer your funds via NEFT, RTGS or IMPS. You can select IMPS too for transfering fund.

3. You will need the full payee name, bank account number and IFS code to complete the transfer. If you transfer funds through your bank's mobile application, you also need a mobile money identification (MMID) for IMPS.

4. The MMID is a seven-digit number issued by the IMPS bank if the individual uses mobile banking as the recipient. When performing IMPS via a mobile phone, the recipient also does not have to enter data.

5. Payment for the use of the IMPS protocol is determined by the bank. However, the fee for transferring funds to Rs 1 100 000 is usually Rs 5 and for transferring between Rs 1 Lakh and Rs 2 Lakh it is up to Rs 15

With IFSC codes, online money transfers are much easier and easier. The RBI provides this code to bank branches for easy transfer of NEFT, RTGS and IMPS funds. To find out how the IFSC works when transferring money, let's take an example. The IFSC code for the HDFC Saket at the Delhi office is HDFC0000043.

1. Here, the first four digits indicate the bank that is the HDFC bank.

2. The fifth digit is always "zero".

3. The remaining 6 characters 000043 help the Reserve Banks of India (RBI) identify the bank's branch

Tell us how the IFSC works during the transaction. You must provide the recipient's bank account number and IFS code when making the transfer. Once the payer has provided all the necessary information, the funds will be easily transferred to the payee's account using the IFSC code. The transfer of IFSC funds takes only a few minutes from the start time. IFSC can also be used at the time of purchase of mutual funds or insurance through Net banking. Because the National Clearing Cell Reserve Bank of India monitors all transactions, the IFS code helps the RBI track various trades and make fund transfers without problems.

Nowadays, most people choose this or online procedure to transfer funds from one account to another. The process of electronic funds transfer is not only simple but also smooth. In addition, it will save you the trouble of going to the bank and prudent transfer of funds. To successfully transfer your money from one account to another, take a few simple steps. Let's look at these steps.

1.Especially for using the online services offered by your bank, it is important that you sign up for internet banking services.

2.You must register the payee's account as the payee for third party transactions. (Please note that recipients link to third parties from banks other than yours)

3. You must add the payee's account and the payee's bank code.

The process of transferring funds using IFSC codes is not as complicated as it seems. Instead, it's easier and hassle-free. When processing a transfer of funds from one account to another, the IFSC code is important to facilitate the transfer. There are different ways to transfer fund using IFSC codes. Let's look at this method.

Today, almost every smartphone has an application. You can use the banking app in the Google Play Store / Appstore. In addition, you can transfer funds through the application. Here are some basic steps you can take to begin the treatment preparation process.

1.You must first activate a network banking system for your account.

2.Download your bank's internet banking application.

3. Open the application; Enter your login PIN or credentials, such as customer ID and account opening password.

4.Select a funds transfer option; You will see various options for transferring third-party funds, such as:

Between my accounts

Within the bank

Immediate transfer to another bank-IMPS

To another bank - NEFT

Via Visa Card

5. Select the option to transfer NEFT funds.

6. If you have not added a payee, first enter them by entering the payee name, bank account number and IFSC code of the relevant bank branch.

7. When the registration process will complete, it will take from 5 minutes to 12 hours to transfer the amount to the payee's account. This time to link accounts generally depends on the bank's policy.

8. After linking the payee's account to with your account, you can instantly transfer the money to the payee's account.

You can also transfer money via SMS using the IFSC code. Let's see how you can transfer funds via SMS. 1. To transfer money via SMS, you must first link your mobile phone number to your bank account by registering your mobile bank number. 2.To register, you must fill out a form after which you will be sent a starter kit containing a unique seven-digit number, ie. MMID and mPin.

3.When registering, you must make an SMS and write IMPS along with the recipient's information, such as the payee's name, account number, IFSC payee's bank, and the amount you want to transfer. 4. After confirming the transaction, you will receive a confirmation message where you should enter your mPin. 5. After entering mPin, press ok and the funds will be transferred to the beneficiary's account.Using these methods, you can easily transfer fund to the recipient's account using IFS code.

An entity regulated by the RBI, the National Payment Company of India (NPCI), has developed an instantaneous payment system known as the Unified Payment Interface (UPI). UPI operates through the IMPS infrastructure and allows instant money transfers between two bank accounts. If you are registering for this service for the first time, you will need to create a four- to six-digit UPI PIN (Personal Identification Number). You must enter a UPI PIN to perform all UPI transactions. UPI payment methods allow you to transfer funds offline and online. In addition, a natural person may transfer funds at any time, regardless of the bank's working hours.