A savings account is a deposit account held in a bank or other financial institution, where you can save additional money and earn interest and get the money when you needed. It is the primary type of banking tool that an individual uses and one of the safest ways to provide easy access to your hard-earned money when you need it. You can deposit funds in cash or checks to your savings account or you can transfer funds from another savings account using IMPS / NEFT / RTGS / UPI and earn interest on those deposits that are credited to your account on a quarterly basis. The interest rate applied to a savings account usually ranges from 3.5% to 7% and varies from bank to bank. You can withdraw money by visiting a bank branch and withdrawing a check / payment slip drawn on the account or at an ATM using a debit card linked to the account. In most cases, you must maintain a minimum average balance for a quarter or month in accordance with banking rules and regulations. However, banks also offer zero-balance sheet accounts, which comes without the hassle of maintaining a minimum balance on a savings account.

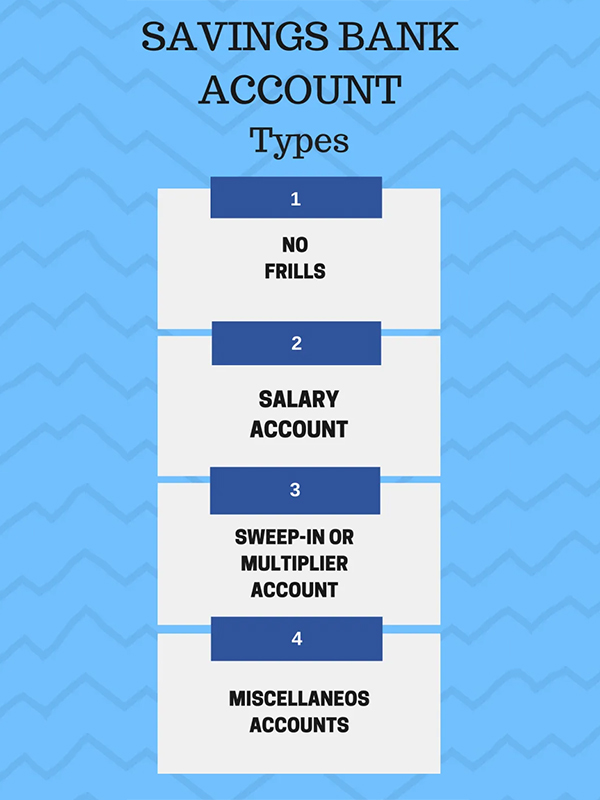

Recently, banks came up with different types of savings to serve customers from different age groups and workplaces. Depending on your eligibility and preferences you can open one of the banking accounts listed below. Each bank offers different accounts, which differ in its profits and benefits, depending on the needs of your personal security account that you can choose the appropriate option. Exact banking types available in India include the following:

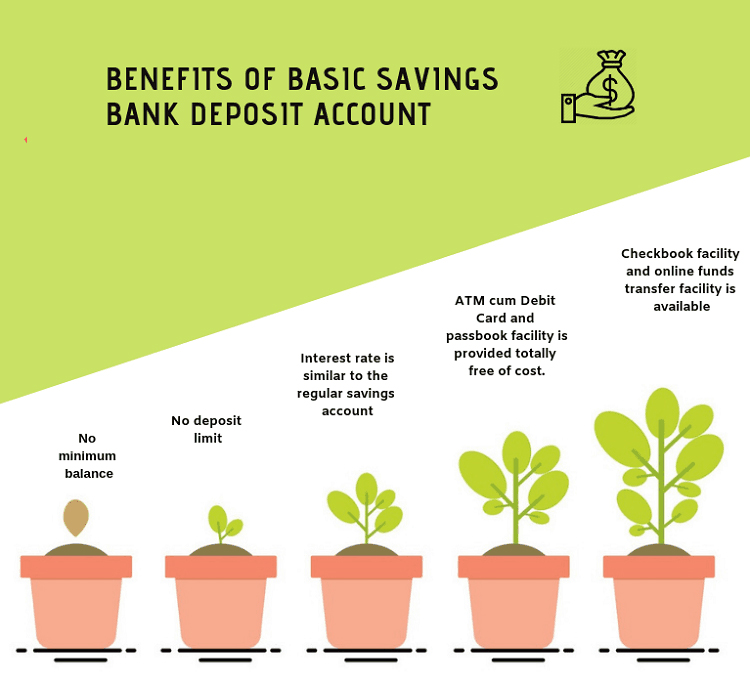

The most important benefit of setting up a savings account is that it helps you develop a savings habit and you can earn interest on this amount. The features of the savings account vary depending on the type of account chosen. Here are some common features to help you understand the benefits of opening a savings bank deposit account:

Applying for a savings account does not require applicants to meet income or employment conditions. Eligibility criteria for opening a savings account are minimal and may vary from bank to bank, but here are some common requirements-

Nowadays, you can easily open a savings account online without any difficulty. To open a savings account online, simply submit the details of the following documents online to eKYC:

Aadhaar Card: Anyone wishing to open an online savings account will need to provide an Aadhaar card number.

Pan Card: Each applicant will need to provide a Pan Card number with the Aadhaar card to open an online savings account. The government has made it mandatory to open a savings account through Pan Cards and Aadhaar Cards through any channel, online or offline.

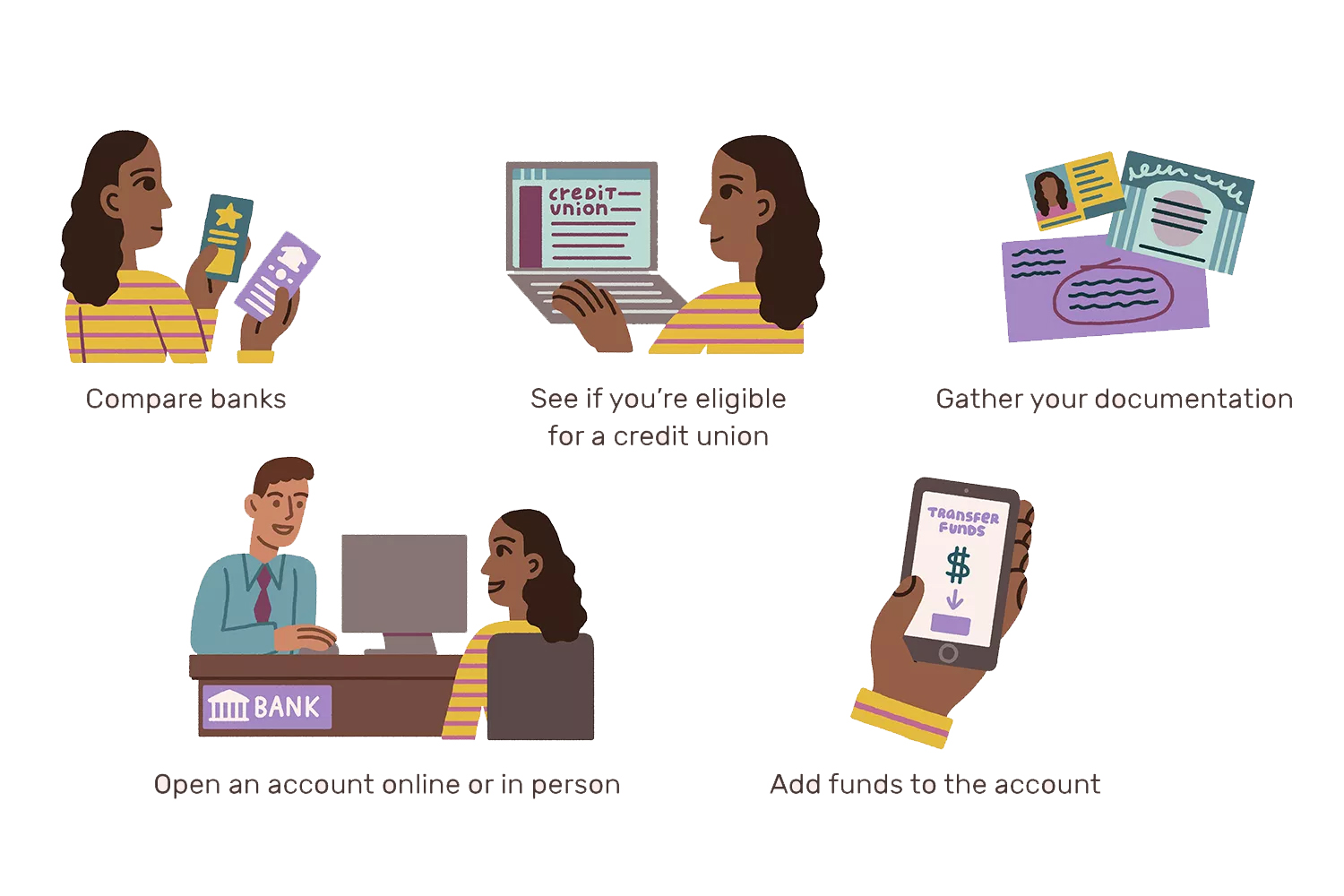

You can open an online savings bank account from the comfort of your home. Follow a simple procedure:

Review and compare different banks and their interest rates and choose the one that best suits your needs.

Note: All banks tend to have different procedures for creating online accounts.

Fill out the savings account application form and submit it along with your Aadhaar number and Pan number to complete the eKYC successfully. Once posted, you can start using your savings account immediately. After that, the banks will send their manager to complete the verification. Note: The procedure for opening an online savings account varies from bank to bank. You can also open an offline savings account with minimal documentation. The bank usually requires KYC documents and travel photos along with an account opening form.

Documents to be submitted using the savings account opening form include:

Passport-size photo Identity and proof of signature (optional): passport, panoramic card, driver's license, electoral license, Aadhaar card, employee ID card for civil servants. Note: Aadhaar and Pan cards are required to open a savings account. However, banks may require any additional proof of identity to complete verification.

Proof of address (optional): Bank statement, lease agreement, voter's ID card, report card, passport, driver's license, phone card, electricity / water / credit card bill, or property tax.

For most banks, the interest rate on a savings account ranges from 3.5 to 7%. For example, Kotak Mahindra offers an interest rate of 6% on payroll accounts, while DBS offers an interest rate of up to 7% on savings accounts. Some state-owned banks also offer an interest rate of 3.5% on their savings accounts. These rates are subject to change in accordance with the RBI Directive, and banks offering higher interest rates often require a higher minimum balance. But today banks such as Kotak Mahindra Bank, DBS and IndusInd Bank provide high interest rates without requiring a minimum balance.

The provision of savings accounts to customers is the primary business of banks, so all banks (private and public) that offer services provide savings accounts service. Some of the best saving account in India is digibank by DBS. Kotak Mahindra Bank , Axis Bank, Yes Bank, IDFC Bank, IndusInd Bank , Citi Bank, ICICI Bank, Standard Chartered Bank , State Bank of India, as well as others. Banks offering best savings account choices for Indian Citizens with high interest rates are as follows:

DBS Bank

DBS is headed by the Asian financial services division and is top leading Bank. This bank has set up its own service of saving account to those customers who are seeking high interest rate on their low saving balances. It offers a 7% return on investment per year.

IndusInd Bank

Indus Indian is an Indian bank founded in 1994 and is the first bank of new generation private banks in India. The bank offers interest rates of upto 6%.

Kotak Mahindra Bank

Kotak Mahindra Bank is an Indian private sector bank with a head office in Mumbai. The bank offers interest rates of up to 6% per year. On the balance in the savings account.

IDFC Bank

IDFC Bank received a universal banking license on 1 October 2015 and they has been raising the bar because of the best service in all the manner. The bank offers savings accounts at 4% per annum.

Yes Bank

YES Bank is a leading private sector bank offering a 6.25% interest rate offered for account amounts in excess of Rs. 1 lakh.

Axis Bank

Axis Bank is a leading private sector bank, which offers interest rate of 3.5% p.a. they offered this interest whose account balance of less than Rs. 50 lakhs and up to 4% p.a. on savings account balance more than Rs 50 lakhs.

Every one can open savings account in Indian Post Office visit to the nearest post office branch and fill the form. The features of a savings account at Indian Post Office is below:

It is important to make a good choice of research, because with so many options on the market it is difficult to make a choice just by looking at the wide range. Therefore, it is advisable to compare investment accounts with different balances to increase your payments and get a better return. We have now listed many restrictions to help you make the right choice.

Savings Account Interest Rate

Most banks offer a rate of 3.5% on savings bank accounts. But there are many banks that offer high interest rates of up to 7% provided the minimum balance is maintained on the savings account.

Minimum balance to be maintained

Some banks require you to have a down payment on your savings account, while others do not. If you fail to keep the balance in your account, the bank may charge you a fine. Therefore, it is best to check what is best for you, a savings account with a balance or a savings account with zero balance.

Additional facilities

Banks offer a wide range of savings account services like net and mobile banking ,free checkbooks and doorstep cash deposit/withdrawal,Such services help to carry out banking operations without visiting the bank and without leaving your home or office. Check the services associated with your saving account before opting any bank in India.

Debit card deals

Savings bank accounts currently come with a debit card. Because most banks are expanding the offers and deals on their debit cards to attract new customers, you should check your debit card plans before choosing a savings account. Consider the bank that offers debit card deals that can give you the most value. Nowadays, banks also provide several offers and discounts on debit cards such as BookMyShow, Yatra coupons and discounts.

Question: Do I have to be over 18 to open a savings account?

Answers Yes. You must be over 18 to open one savings account. However, the minor may be the account holder in association with an adult family member as a parent / legal guardian.

Q: Do all banks provide control?

Answers Yes. All banks provide a control system, but for many public sector banks you have the option of choosing a basic savings account that does not have a control system. In this case, you can only withdraw cash by visiting the bank and using the withdrawal receipts available at the branch. In addition, DBS and Kotak 811 have bank accounts only for mobile devices, such as Digibank, which do not contain a checkbook.

Q: Are there ATM card payments associated with a savings account?

Answers Yes. Debit cards at ATMs are subject to an annual fee of around Rs 150 plus applicable taxes (varies from bank to bank). However, many private sector banks will waive the annual fee provided that you use your debit card for certain transactions at nominal value during the year or if you adhere to the minimum average balance set by the bank.

Q: How do I check the status of my savings account?

Answers You can check your savings account balance online through network banking, or at your bank or any ATM. Nowadays, almost all banking transactions can be done online and you don't have to visit the bank in the same ways. You can access your account online via network banking and also via mobile banking.

Question: Is savings account taxable?

Answers Interest income of up to Rs 1,100, which accrues on the balance of your savings account, is tax-exempt under Section 80TTA. When you earn High amounts from interest is subject to TDS.