Life insurance is an agreement between an insurance company and a policyholder offering financial cover, under which the insurance company is obliged to pay a certain amount to the appointed entitled in the event of an accident where the policyholder ceases to exist during life insurance. In return, the policyholder promises to pay the said amount regularly or only as a one-off premium. Where this policy applies, coverage for critical diseases is also provided.

According to the name, online life insurance plans are available. Online life insurance plan offers many benefits like death benefits, accidental benefits and they are offering high amount insurance with a low premium. In addition, online life insurance plans offer several tax benefits under Section 80CCC of the Income Tax Act of 1961.

A life insurance premium is a payment that is due so that you can take advantage of life insurance. Life insurance premiums are paid annually; however, the method of payment of insurance premiums can also be chosen from a monthly or semi-annual period. The insurance company determines the premiums paid by the insurance company's policyholders. For this reason, the insurance buyer chooses the duration of the insurance contract and coverage. When calculating the sum insured from life insurance, the insurer takes into account various factors, such as your lifestyle, occupation, number of dependents, funds, sum insured, etc.

Note - There is not such premium calculator device created which calculate the value of human life.

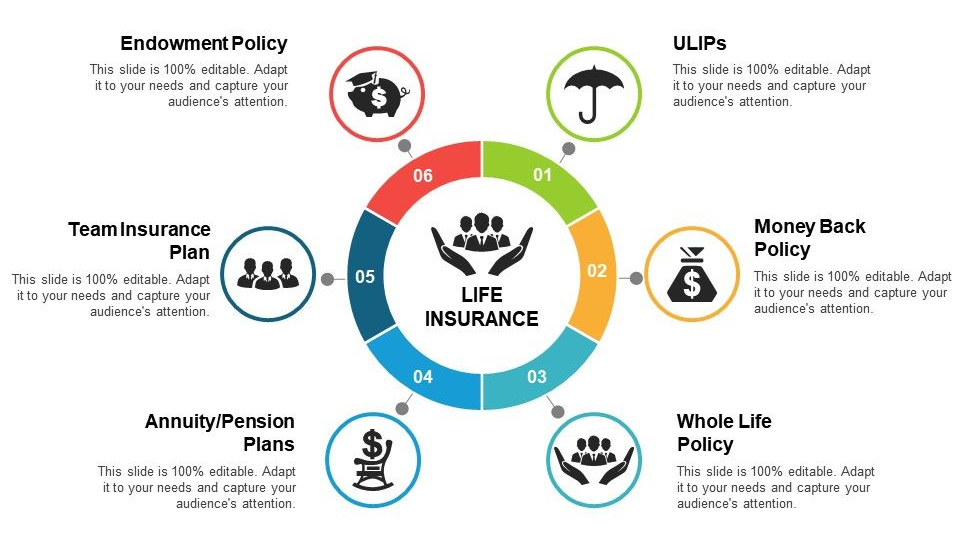

Listed below are the best life insurance policy plans:

| Aegon Life i-Term Plan | 18/75 years | 5/40 years | 10 Lakh/ no upper limit | APPLY NOW |

| Aviva Life Shield Advantage Plan | 18/55 years | 10/30 years | Option A - 35 Lakh/ no upper limit Option B- Rs.50 lakh/ no upper limit |

APPLY NOW |

| Bajaj Allianz i-Secure | 18/70 years | 10/30 years | 20 Lakh/ no upper limit | APPLY NOW |

| Bharti AXA Life Premium Protect Plan | 18/65 years | 10, 15/35 years | 25 Lakh/no upper limit | APPLY NOW |

| HDFC Click2 Protect Plus | 18 /65 years | 10/30 years | 10 Lakh/10 Crores | APPLY NOW |

| HDFC Life Sanchay | 30/45 years | 15/25 years | 1,05,673/ no upper limit | APPLY NOW |

| ICICI Pru iProtect | 20/75 years | 10/30 years | 3 Lakh/ no upper limit | APPLY NOW |

| Kotak Life Preferred e-Term | 18/75 years | 10/40 years | 25 Lakh/ no upper limit | APPLY NOW |

| LIC Jeevan Amar | 18/65 years | 10/40 years | 25 Lakh / no upper limit | APPLY NOW |

| LIC Tech Term | 18/65 years | 10/50 years | 50 Lakh / no upper limit | APPLY NOW |

| Max Life Online Term Plan | 18/70 years | 10/35 years | 25 Lakh / 100 Crores | APPLY NOW |

| SBI eShield Plan | 18/70 years | 5/30 years | 20 Lakh / no upper limit | APPLY NOW |

| SBI Shubh Nivesh Plan | 18/60 years | 5/30 years | 75000 / no upper limit | APPLY NOW |

| Aditya Birla Sun Life Shield Plan | 18/65 years | 10, 20/30 years | Rs.25 lakh/no upper limit | APPLY NOW |

| Canara HSBC iSelect + Term Plan | 18/65 years | 10/30 years | Rs.25 lakh/no upper limit | APPLY NOW |

| Edelweiss Tokio Life Simply Protect Plan | 18/65 years | 10/40 years | Rs.25 lakh/no upper limit | APPLY NOW |

| Exide Life Smart Term Plan | 18/65, 60 years | 10,12/30 years | Rs.5 lakh, 10 lakh/NA | APPLY NOW |

| Future Generali Flexi Online Term Insurance | 18/55 years | 10/75 years | Rs.50 lakh/no upper limit | APPLY NOW |

| IDBI Federal Income Protect Plan | 25/60 years | 10/30 years | N/A | APPLY NOW |

| India First Life Plan | 18/60 years | 5/40 years | 1 lakh/ Rs.5 crore | APPLY NOW |

| Kotak Preferred e-Term Plan | 18/65 years | 5/40 years | Rs.25 lakh/ no upper limit | APPLY NOW |

| PNB Metlife Mera Term Plan | 18/65 years | 10/40 years | Rs.10 lakh/no upper limit | APPLY NOW |

| Pramerica Life U-Protect | 18/55 years | 10/30 years | Rs.25 lakh/no upper limit | APPLY NOW |

| Reliance Nippon Life Protection Plus | 18/60 years | 10/40 years | Rs.25 lakh/no upper limit | APPLY NOW |

| Sahara Shrestha Nivesh Jeevan Bima | 9/60 | 5/10 years | Rs.30,000/ Rs.1 crore | APPLY NOW |

| Shriram Life Cashback Term Plan | 12/50 years | 10,15,20 &25 years | Rs.2 lakh/Rs.20 lakh | APPLY NOW |

| SUD Life Abhay Plan | 18/65 years | 15, 20/40 years | Rs.50 lakh/--- | APPLY NOW |

| TATA AIA life Insurance Sampoorna Raksha + |

18/70, 65 years | 10, 15/40 | Rs.50 lakh/no upper limit | APPLY NOW |

The benefits of buying life insurance go beyond protecting the family of policyholders in difficult times. There is no doubt that there is a need for the breadwinner to provide for dependents in the event of their unfortunate and premature death, accident or disability, which leads to loss of income. However, there is a long list of other benefits that make life insurance plans a necessity. Unfortunately, most people are not aware about the benefits of the life insurance offers. They only care about the benefits in case of death and disability. However, life insurance offers many other benefits, such as maturity, tax benefits and the like.

Let's look at the benefits that life insurance plans offer:

Many people still do not know that life insurance can also be used as a loan guarantee. Based on the type of life insurance contract and the value of the transfer, the policyholder can decide on a loan from the bank or NBFC (non-bank finance company) according to the eligibility requirements. Loan amount: The loan amount is usually a percentage of the value of life insurance exemption and can reach up to 90%. Some companies allow loans up to 50% of the total premiums paid by policyholders.

A large number of individuals are unaware of the benefits of online payments (the payment regime chosen by individuals drastically affects life insurance premiums). When an individual decides to pay their premiums online, the administrative costs of the insurance company will be significantly reduced. This is because there are no administrative costs involved. Life insurance companies can also save a large amount of commissions they pay agents for the purchase and renewal of life insurance offline.

Note: This discount varies by company.

Almost every life insurance company offers different payment periods to policyholders - annual, semi-annual, quarterly or monthly. If the policyholder decides to pay the premium annually, the company will use the premium amount for investment purposes, which automatically means greater profits and profits for the company. If the policyholder chooses the frequency of payment, this discount is already included in the insurance rate charged by the life insurance agent.

There are life insurance companies that give policyholders a choice as to who owns the business. If the termination of the policyholder is terminated, the business partner can easily purchase the policyholder's share. In this scenario, the business partner only needs to sign an agreement with the life insurance company and the payment received after the sale of the policyholder's share will be made to the dependents. However, it is important to understand that nominated or dependent policyholders will not gain an interest in the company.

For the purpose of paying life insurance premiums, the insured person is entitled to tax relief under section 80C of the Income Tax Act 1961. Regardless of himself, spouse or children, premiums paid for parents and leave are exempt. This advantage is offered by all life insurance companies - whether private life insurance companies or public sector life insurance companies. In addition, life insurance contracts are entitled to tax deduction under Section 10 (10D) of the Income Tax Act 1961.

| Life Insurance Plans | Coverage |

| Term Plans | Pure risk cover |

| ULIPs | Insurance + Investment benefits |

| Endowment Plans | Insurance cover + Savings |

| Money Back Plans | Insurance cover with periodic returns |

| Whole Life Insurance Plans | Coverage for a lifetime period |

| Child Plans | To create a corpus for child's education, wedding etc. |

| Retirement Plans | Financial cushion aiding financial independence post retirement. |

Term insurance is the most basic form of life insurance. It is an affordable life insurance that one can buy without any problems. In short, a term insurance plan offers insurance coverage in the event of death for a specified period of time. God, in the event of a sudden dismissal of a policyholder during the term of their term, the insurance provider, the insurance provider, offers the death benefit which has been determined as a lump sum, as a monthly / annual payment or as a combined benefit for the nominee. The best plan offers comprehensive coverage for a competitive premium.

Benefits of a Term Insurance Plan Death benefits: Death benefits are paid as monthly payments, all at once or both.

Note - If the policyholder continues to follow the rules, no payment will be made.

Additional drivers:

To increase the coverage of life insurance offered under the basic policy of life, the plan comes with a variety of optional drivers. The insured person can choose the same according to their expectations.

ULIP Benefits

The best of both worlds - it offers benefits covering life and investment.

Easy investment - Based on risky tastes, insurance offers buyers a variety of investment options.

Full autonomy - offers full autonomy in choosing the investment options of choice for insurance buyers.

The basic program is also called a traditional life insurance plan. This plan is accompanied by research elements. Compared to other investment product risk factors, the risk is lower (as is the return). Subsidy policies are a combination of life protection plans and savings plans. It invests a certain amount of money in life insurance and the rest is invested by the provider. If the policyholder survives the insurance period, the insurance provider offers him an advantage at maturity. In addition, some insurance policies may offer bonuses on a set date. The policyholder is paid a bonus at the time the insurance contract expires or in the event of the policyholder's death. Endowment plan contribution Return on investment - serves as a tool for long-term financial planning, offering return on investment at maturity.

This type of life plan, by name, offers a specified percentage of the sum insured. It will be returned to the policyholder within the agreed time interval. This dose is called survival dose. Money back is the best type of life insurance for individuals who want their investments accompanied by liquidity. In addition, the program is eligible for the bonus set by the provider (if any).

Fulfilling short-term financial goals - serves as a tool to achieve short-term financial goals and is a unique opportunity to earn a return on investment at maturity.

The entire life insurance plan offers life insurance coverage as long as life is insured. There are several providers that offer life insurance up to 100 years. Unlike insurance coverage offered in time plans, these plans offer extensive life insurance. The sum insured is calculated when purchasing a life insurance program and is paid to the nominee upon termination of insurance. Along with the guaranteed amount, the bonus (if any) is also paid to the candidate. This is one of the best life insurance policies, offering life insurance at a low premium.

There are various life insurance variants on the market that combine the benefits of a life insurance plan with ULIP. ULIP lifetime offers extensive coverage with high returns.

Note - If the policyholder lasts for 100 years, the insurance provider will pay the insurance interest payable to the policyholder.

Coverage - This Offers lifetime insurance for the applicant.

Partial withdrawals - At the end of the premium payment period, it offers partial withdrawal options

Age without bars - there is no age limit in terms of eligibility criteria.

Child Plans

The children's plan serves as a tool for generating funds for the insured child. Children's plans help someone build a corpus for their child that can be used to raise and issue the child. Plans for children are usually provided either as an annual installment or as a one-off payment when the insured child is 18 years old.

In the event of an accident in which the policyholder stops prematurely during the insurance period, the insurance company is obliged to pay the premium immediately. In such cases, several life insurance providers waive future premiums, but the plan continues until the chosen insurance period.

Parental Plan Benefits

A secure future - Even if the parents of the insured child are lost, this will ensure the future of the insured child is secure.

Financial support - Helping parents raise funds for important events in their child's life, such as education, marriage, etc.

Retirement plans

Retirement plans, also known as annuities or retirement plans, help policyholders gather retirement bodies. Pension schemes usually provide benefits in the form of annual installments or lump sum payments when the insured party is 60 years old. If the policyholder survives the insurance period, the plan provides a legitimate advantage. In the event of the dismissal of the insurer, the insured offers the proposed death benefit.

Note - If the policyholder is terminated during the period of active insurance policy, life insurance pays the amount that has been determined to the nominated policyholder.

Benefits of a pension plan

Corpus Generation - Helps policyholders build a corpus for retirement.

Get the Financial independence - It provides policyholders with much-needed financial independence at any age.

Long-term savings can be done - When any one think about the long-term savings this is the great tool for it.

Retirement goals - The insurance helps to achieve retirement goals with full autonomy.

Death Benefit - It also provides a death benefit that is either the value of the fund or 105% of the premium paid.

Benefit - This program gives the value of the fund as a payout.

Health insurance is a type of insurance that provides financial protection for the cost of health care in an emergency. The Health Insurance program provides insured insurance to several insured persons, including cashless admission to hospitals, day care facilities and coverage for fatal and critical illnesses, etc.

Health insurance is a contract between an insurance company and a policyholder in which the insurance company provides financial protection for medical expenses incurred by the insured. Health policies provide the benefit of substituting medical expenses or non-monetary treatment specified in the health policy. More than the health insurance, health insurance plans also offer the tax benefits which is under section 80D of the Income Tax Act 1961. Healthcare costs are soaring that one hospitalization is enough to get rid of your lifelong savings. With cashless devices, keep your savings untouched by the best health insurance plans from various insurance providers.

An individual health insurance plan from the best insurers

| Insurance Companies | Health Insurance Plans | Sum Insured (Rs.) | Incurred Claim Ratio | Network Hospitals |

|---|---|---|---|---|

| Aditya Birla Health Insurance | Active Assure Diamond Plan |

Min – 2 Lakh Max – 2 Crore |

59% | 6000+ |

| Bajaj Allianz Health Insurance | Health Guard Plan | Min – 1.5 Lakh Max – 50 Lakh |

85% | 6500+ |

| Bharti AXA Health Insurance | Smart Health Assure Plan |

Min – 3 Lakh Max – 5 Lakh |

89% | 4300+ |

| Cholamandalam Health Insurance | Chola Healthline Plan | Min – 2 Lakh Max – 25 Lakh |

35% | 6500+ |

| Digit Health Insurance | Digit Health Insurance Plan |

Min – 2 Lakh Max – 25 Lakh |

11% | 5900+ |

| Edelweiss Health Insurance | Edelweiss Health Insurance Plan |

Min – 5 Lakh Max – 1 Crore |

115% | 2578+ |

| Future Generali Health Insurance | Future Generali Criticare Plan |

Min – 5 Lakh Max – 50 Lakh |

73% | 5000+ |

| HDFC Ergo Health | Health Optima | Min – 3 Lakh | 63% | 10,000+ |

| Insurance ( formerly known as Apollo Munich Health Insurance) | Health Optima Restore Plan | Max – 50 Lakh | ||

| HDFC Ergo General Health Insurance | My:health Suraksha Silver Smart Plan |

Min – 3 Lakh Max – 50 Lakh |

62% | 10,000+ |

| IFFCO Tokio Health Insurance | Heath Protector

Plus Plan |

Min – 2 Lakh Max – 25 Lakh |

102% | 5000+ |

| Kotak Mahindra Health Insurance | Kotak Health Premier Plan |

- | 47% | 4800+ |

| Liberty Health Insurance | Health Connect Supra Top-up Plan |

Max – 1 Crore | 82% | 3000+ |

| Max Bupa Health Insurance | Companion Individual Health Plan | Min – 3 Lakh Max – 1 Crore |

54% | 4115+ |

| ManipalCigna Health Insurance | ProHealth Plan | Min – 2.5 Lakh Max - 1 Crore |

62% | 6500+ |

| National Health Insurance | National Parivar | Up to 50 Lakh | 107.64% | 6000+ |

| Mediclaim Plus | ||||

| New India Assurance Health Insurance | New India Assurance Senior Citizen Medi claim Policy | Min – 1 Lakh Max – 15 lakh |

103.74% | 3000+ |

| Oriental Health Insurance | Individual Mediclaim Health Plan | Min – 1 Lakh Max – 10 Lakh |

108.80% | 4300+ |

| Religare Health Insurance | Care Health Plan | Min – 4 Lakh Max – 6 Crore |

55% | 7400+ |

| Raheja QBE Health Insurance | Health QBE | Min- 1 LakhMax – 50 Lakh | 33% | 2000+ |

| Royal Sundaram Health Insurance | Lifeline Supreme Plan | Min – 5 lakh Max – 50 Lakh |

61% | 5000+ |

| Reliance Health Insurance | Critical Illness Insurance | Min – 5 Lakh Max – 10 Lakh |

14% | 4000+ |

| Star Health Insurance | Family Health | Min – 1 LakhMax – 25 | 63% | 9800+ |

| Optima Insurance Plan Lakh | ||||

| SBI Health Insurance | Arogya Premier Policy | Min – 10 Lakh Max – 30 Lakh |

52% | 6000+ |

| Tata AIG Health Insurance | Tata AIG MediCare Plan | Min – 2 lakh Max – 10 Lakh |

78% | 3000+ |

| United India Health Insurance | United India UNI Criticare Health Plan | Min – 1 Lakh Max – 10 Lakh |

110.95% | 7000+ |

| Universal Sompo Health Insurance | Individual Health Plan | Max – 10 Lakh | 92% | 5000+ |

Health insurance will help you whenever you need medical treatment. If you become ill or ill, you have an accident and the like, health insurance provides coverage for expenses incurred and also provides other benefits. A health insurance plan basically protects you from any health risks. Provide if there is a high cost of health care. Anxiety can happen anywhere, anytime and easily make you depressed and take you financially and emotionally. In today's era of life and lifestyle, it is important that every individual is insured in health insurance. In addition to the increase in the number of diseases and the price of health care in our country, it is also necessary to have health insurance, as it provides financial deposits in the event of a medical emergency. Unfortunately, only 20% of the total population in India has health insurance. In addition, only 18% of the total population living in urban areas and 14% of the total population living in rural areas have any form of health insurance. Everyone must buy good health insurance, which includes benefits such as hospital expense cover, cost of medications and laboratory tests, including critical illness, and more. Some health plans cover OPD expenses up to a certain amount.

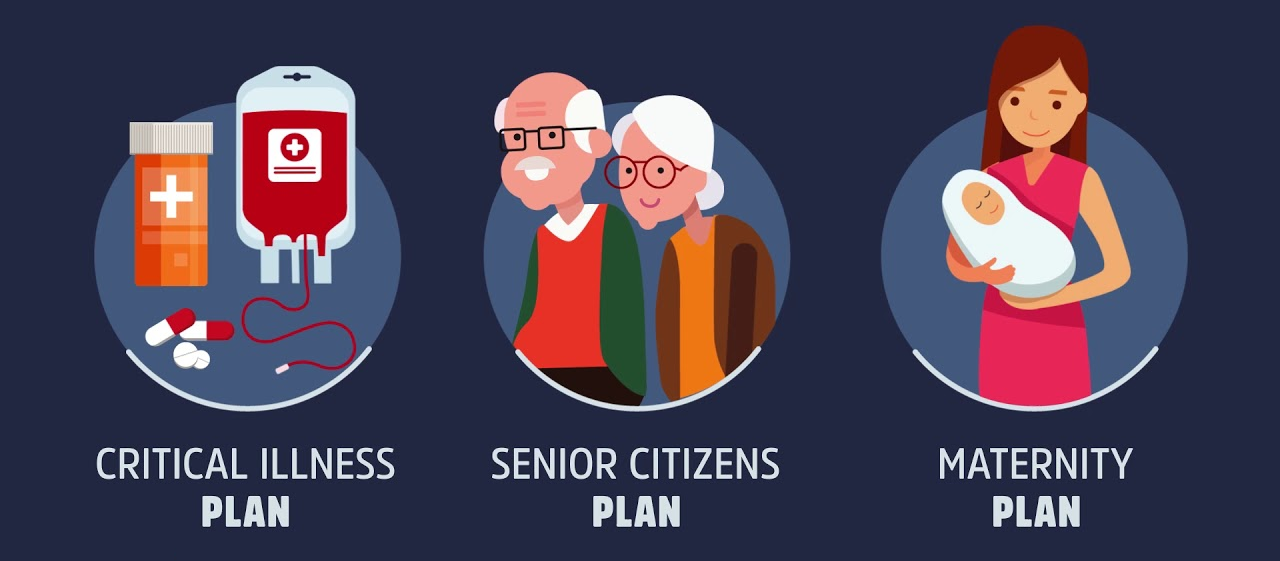

Must be ensure that the health insurance plan which you purchase should meets your insurance needs, it is very important to know the different types of health insurance plans and after knowing you will able to purchase right policy. Here are the different types of health insurance programs that you can choose according to your insurance needs:

Individual health insurance plans offer insurance coverage with benefits such as cashless hospital admission, reimbursement of expenses, reimbursement of expenses incurred before and after hospitalization, home treatment coverage and more. Individual health plans come with additional coverage that enhances basic health insurance with a minimum premium.

Family health insurance offers single family insurance for the whole family. Under this health plan, the sum insured is evenly distributed among the members of the insurance contract, which can be used by one or all family members in one or more events insured during the term of the insurance contract. With a family health plan, almost all family members can be added to one health insurance premium.

The health insurance plan for the elderly offers insurance for the age group of 60 years. The health insurance program covers the cost of hospital admission, including expenses for hospital treatment, expenses for OPD, day care services, pre-hospital and post-hospital expenses, along with 80 D tax reduction benefits.

A critical illness health insurance plan offers a large amount if the insured person has been diagnosed with a critical illness, such as kidney failure, paralysis, cancer, heart attack, etc. insurance.

Maternity health insurance plans provide coverage for maternity expenses incurred during prenatal and postpartum care, during childbirth (normal or caesarean section). Some providers also include the cost of newborn vaccination in maternity health insurance plans. The coverage list also includes the fee to take the mother to the hospital of the nearest network of her choice.

Personal accident insurance is insurance coverage for drivers who offer insurance coverage in the event of an accident that causes disability or death. This insurance covers hospitalization and bears medical costs in the event of an accident. Fixed cash benefits are provided in the event of an accident resulting in loss of income.

More than 80% of employers now provide health insurance to their employees. The health insurance offered by the employer covers the cost of admission to the hospital of the employee and his or her family, including spouse, children or parents. It is a sensible decision to choose a medical card offered by your company, as you do not have to pay insurance premiums. These are administered by group health insurance and premiums are paid by the employer based on the group measurements and benefits offered.

The Health Insurance Investment Plan (ULHP) is a newly introduced health plan. This unit's health insurance plan offers a unique combination of health insurance and investment. In addition to health coverage, ULHP also contributes to developing a corpus that can be used to cover expenses not covered by health insurance plans.

The cost of health care is rising at an insane level today, while human income does not seem to be on par with this level. A patient who is awaiting regular medical examinations may no longer be able to bear the associated costs. A comprehensive health insurance plan includes features that can help a person manage the costs associated with a medical emergency, as well as preventive screening. Some health insurance plans also offer additional coverage of OPD expenses.

Every health insurance company has relationships with various hospitals and hospitals across the country, called "empaneled hospitals." If you are accepted as one of them, you do not have to pay anything. All you have to do is state your insurance number and everything else will be taken care of by your hospital and insurance company. This type of health insurance plan is preferred because there is no pressure in paying claims and documentation. However, if your expenses exceed the sub-limit set by the insurance cover or are marked as not covered by the provider, you must pay it directly at the hospital. Another important thing to keep in mind is that cashless medical treatment is not available if hospitalized, which is not part of the insurance company's network of hospitals.

Expenses before and after hospitalizationThis health insurance feature manages the costs associated with hospital admission before and after hospitalization. It considers the costs incurred for several days before and after hospitalization as part of the claim, provided the expenses are related to the illness / disease covered.

Rescue Payment

After being admitted to the hospital, the person is exempted from transportation costs as borne by the insurance company.

NCB (or bonus without right to compensation) is a bonus given to the insured if no treatment rights have been filed in the previous year of insurance. Rewards can be offered either as an increase in the guaranteed amount or as a premium discount. You can take advantage of this to renew your policy.

Medical equipmentThe health plan entitles the insured to a regular medical examination. Some insurance companies provide free tours or you can get them as an added benefit.

Partial room rental limit in our health insurance planThere may be different sub-limits related to health insurance; Room rental is one of these sub-limits. The general insurance company gives you maximum coverage up to the guaranteed amount. However, they may deliberately reduce their responsibilities by introducing a sub-threshold clause to cover hospital room rentals. Once the insured is admitted to the hospital, there is a partial limit to cover the daily room rent. For example, if your health insurance contract covers your daily room rent up to a maximum of Rs. 3,000 and the cost of your room is Rs. 5,000 a day, then you have to pay the balance of R. 2,000 from your own pocket. In addition, room fees are directly related to the type of hospital room you are using, ie. A. With one room or jointly. Everything else is calculated accordingly. If the total cost of treatment in the hospital is Rs. 5,00,000, the table below illustrates the expenses that may be borne by the insurance company or you.

| Policy Sum Assured (in Rs.) | 5,00,000 | ||

| Room Rent as per Sub-Limit (in Rs.) | 3,000 | ||

| Room Rent Per Day (in Rs.) | 5000 | ||

| Room Availed at the Hospital (in Days) | 10 | ||

| Actual Hospital Bill (in Rs.) | Reimbursed Amount (in Rs.) | To be Borne by You (in Rs.) | |

| Incurred Room Charges (in Rs.) | 50,000 | 30,000 | 20,000 |

| Doctor's Fee (in Rs.) | 20,000 | 12,000 | 8,000 |

| Medical Tests' Cost Incurred (in Rs.) | 20,000 | 12,000 | 8,000 |

| Operation/Surgery Cost (in Rs.) | 2,00,000 | 1,20,000 | 80,000 |

| Incurred Medicine Cost (in Rs.) | 15,000 | 15,000 | 0 |

| Total Expenses Incurred (in Rs.) | 3,05,000 | 1,89,000 | 1,16,000 |

In this case, your total cost is Rs. 1 16,000 of the total expenditure incurred, t. J. Rs. 5 00 000. Therefore, make sure that you have made a reasonable decision if you want to limit such a limit in your health insurance.

With this feature, your health insurance plan can reduce the cost. The health insurance plan offers a joint participation option that determines in advance the voluntary deductions that must be paid by the policyholder. So in the event of a medical emergency, a sum of money will be paid by the policyholder and the rest by the provider. Joint participation is a condition of cost sharing in the context of health policy, which stipulates that the organization or person will bear a certain share (as a percentage) of the total costs that are eligible to be incurred. However, the possibility of mutual financing does not affect the amount secured. This allows you to reduce premiums to a certain extent (depending on the insurance company and the insurance contract).

Disease insurance entitles you to tax benefits under Section 80D of the Income Tax Act 1961. The premium you pay for health insurance for yourself or a family member gives you tax relief, whether it depends on you or not. no. The tax deduction offered in relation to the premium depends on the age insured and the maximum amount of tax deduction available. You can save a maximum of Rs. 25,000 in the fiscal year if you are under 60 years old. If your age exceeds 60 years, the maximum tax benefit will increase to Rs 50,000. If you pay health insurance premiums for parents and yourself, you are entitled to a tax exemption of up to 55,000 R. per annum under section 80D if your parents retire.

Tax benefits are subject to change in tax laws Third Party Administrators

The concept of landfill is the main idea of the Insurance and Development Board of India (IRDA), which assists insurance and insurance agents. While this is beneficial for insurance companies as it reduces overhead or administrative costs, false damage and insurance ratios, policyholders also use better and faster insurance services.

TPA is an important player in the health insurance sector. They have the ability to deal with all or part of the damage associated with a health insurance plan. They have links to their own health or insurance companies that manage services such as premium collection, registration, claims settlement and other administrative services.

Hospitals and health insurance companies often issue health insurance responsibilities to reduce their burden.

Coverage of existing diseases

Two to 4 years after policy making, different policies will begin to take into account existing diseases, e.g. diabetes, high blood pressure, etc. Coverage is provided for available illnesses for certain illnesses owned by policyholders before purchasing insurance.

Preventive Health Care

Health care is undoubtedly very expensive and no one wants to be hospitalized. We now have a preventive medical examination that will take care of you before you get sick. This principle provides preventive treatment, such as regular medical examinations, reduction of X-ray fees, consultation fees, etc. The goal of this plan is to give you various health measures to take care of your health. Preventive care is medical treatment given not based on specific complaints, but for the purpose of prevention and early detection of difficulties.

We are one of the best platforms for loans, credit cards, insurance and banking services. Our aim to make your banking needs easy and convenient for you.