Personal Loan can be a short period and it can be 5 year unsecured loan, it does not need any guarantee or security at the time of disbursal. It is usually disburse in a few hours to a few days with little or no paperwork. A key feature of a personal loan is the flexibility of its use. Therefore, this unsecured loan can be used to meet a variety of needs ranging from emergency medical expenses to planned expenses like home renovation, weddings, etc.

No collateral / security

It is not necessary to present collateral such as a home or car to benefit from a personal loan.

The loan is approved only on the basis of your creditworthiness, which depends on your credit score, income, payment history, employer reputation, etc.

Flexible end use

In addition to a car loan or a home loan, personal loans can be used for multiple purposes, such as covering emergency medical expenses, travel, home renovation, debt consolidation, etc

Flexible time period

Personal Loans come with flexible terms, generally 12 to 60 months.

Minimal documentation

Personal loan can be applied from 2 ways. There are 2 ways to apply for a personal loan online and offline with minimal documentation. The main documents which lenders requirefrom the applicant is proof of identity, proof of address, and proof of income.

Quick disbursement

The personal loan can be disbursed in a short period not exceeding a few hours, once the application is approved. Response times can also be as short as a few minutes, if you can take advantage of a pre-approved loan offer.

Flexible amount of loan

The eligible personal loan amount depends on the individual's payment date, monthly income, age, profession, employer reputation, and other similar factors.

Lenders offer personal loans with a value as low as Rs 10,000 to as low as Rs. 40 lakh.

As the name suggests, a personal loan is offered to individuals, not businesses. Most banks and non-bank finance companies (NBFCs) offer personal loans to both salaried individuals / professionals and the self-employed. The eligibility requiment to get the personal loan vary slightly from applicant to other applicant. Here are some key personal loan eligibility factors to consider *: Documentation requirements also vary from issuer to issuer, and some of the basic documents required to apply for a credit card are as follows:

| Particulars | Salaried | Self-Employed |

|---|---|---|

| Age | 21 - 60 years | 21 - 68 years |

| Minimum Income | Rs. 15,000 per month | Rs. 5 lakh per year (gross) |

| Employment stability | Total experience- Minimum 2 years Experience in the current organization- Minimum 1 year |

Minimum 2 years in current business |

*The eligibility criteria for personal loans mentioned above are general in nature and the actual eligibility factors will vary from one lender to another. Personal Loans are unsecured loans with a flexible end use that generally range from 12 to 60 months. If a shorter period is chosen, the amounts of individual EMI loan amount is higher, while the longer term leads to lower individual EMI loan amount.

1. Ideal For Emergencies: People often look for a personal loan in emergency situations where time can be very important. During such crises, it may not be the most advantageous option to visit the lender, apply for a loan and then wait for a loan. With an online loan application, you can save a lot of time and access funds much faster.

2. Minimum documentation: Documentation is one of the biggest problems in obtaining a personal loan. But even online banking has significantly reduced this inconvenience. Online loan applications only need some of the most important documents, such as your proof of address, proof of address and proof of income. Upload these documents online and fill out the loan application form and apply for a personal loan anywhere, anytime immediately.

3. Immediate approval: Gone are the days when you had to wait a few days for your loan to be approved. For online loans, you can now apply for and approve the loan on the same day, when you submit the correct documents. Not only that, when approving personal loans online, you can also pay the loan amount directly to your bank account on the same day.

4. Consumer friendly online websites: Are you planning to borrow a personal loan for the first time? Don't worry, because online lending portals from the best banks offer all the help and support you need. On their website you will find frequently asked questions, articles, blogs and much more to help you understand the whole process of the comfort of your home. In addition, the entire application process is designed so efficiently that even the primary lender is guaranteed maximum comfort. You can contact the lender's technical support staff at any time if you have any questions.

5. Compare and choose the best offer: With so many lenders offering personal loans online, it can be difficult for a lender to choose the best. With the help of online credit portals, lenders can easily compare offers offered by different lenders.

The Interest rates on personal loans vary from one bank to other bank. Fees are also affected by application-based factors such as the applicant's credit score, loan amount, and tenure.

Below is a comparison of personal loan interest rates from some of the leading banks and non-bank finance companies in India *:

| Bank Name | Interest Rate |

|---|---|

| State Bank of India | 10.50% onwards |

| HDFC Bank | 10.75% onwards |

| Punjab National Bank | 12% onwards |

| Citibank | 10.50% onwards |

| Bajaj Finserv | 12.99% onwards |

| ICICI Bank | 11.25% onwards |

| Tata Capital | 10.99% onwards |

*Updated as of January 2019, rates subject to periodic change.

The annual interest on a loan is calculated using the formula:

Where, I = Interest payable, P = Principal (loan outstanding) and R = Rate of Interest (annual percentage rate)

While the above formula can be used as in case of a personal loan with 1 year tenure, multi-year loan may feature different principal in successive years as the loan is repaid. Subsequently, the interest amount for every year has to be added to get total cumulative interest of a personal loan. To get rid of the need for such complex calculations, it is recommended to use an EMI calculator that instantly provides you with details such as the total interest owed on your mortgage loan.

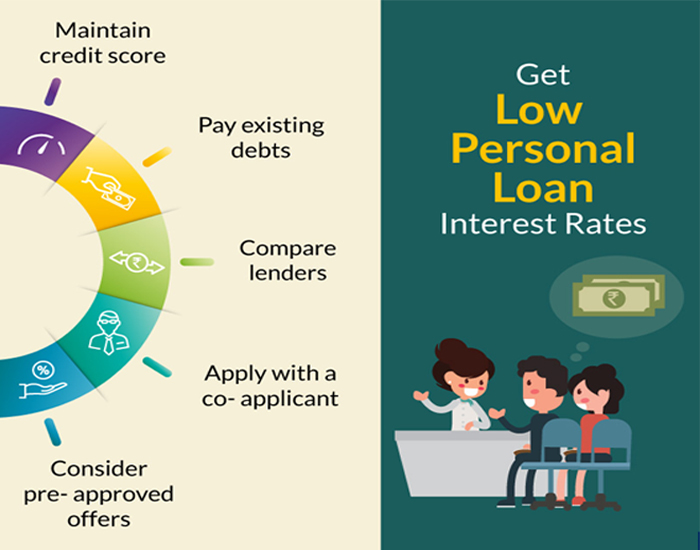

The interest rate that is applied to a personal loan is usually lower if the lender finds that you are financially responsible. Here are some of the ways you can get a low interest rate for your personal loan:

While the tips above are a good starting point for getting lower interest payments on your loan, a low interest rate is not fully guaranteed because there are many factors that affect the interest rate on the loan.

While it may not be possible to get the lowest interest rate for your personal loan, there are three ways to lower your total interest payments on your loan:

It is always a good idea to plan your monthly expenses in advance to avoid financial problems later. Paisabazaar designed a personal loan calculator where you need Just enter the loan amount, interest rate, and duration to calculate your EMI instantly. This can help you make an informed decision on the loan option that best meets your specific requirements. To get an idea of how to calculate EMI loans for personal loans, take a look at the following table:

| Loan Amount | Interest Rate | EMI 1 Year Loan Tenure (Rs.) | EMI for 2 Year Loan Tenure (Rs.) | EMI for 3 Year Loan Tenure (Rs.) | EMI for 4 Year Loan Tenure (Rs.) | EMI for 5 Year Loan Tenure (Rs.) |

|---|---|---|---|---|---|---|

| 1 lakh | 10.50% | 8,814 | 4,637 | 3,250 | 2,560 | 2,149 |

| 2 lakh | 10.75% | 17,653 | 9,298 | 6,524 | 5,144 | 4,323 |

| 3 lakh | 10.50% | 26,444 | 13,912 | 9,750 | 7,681 | 6,448 |

| 5 lakhs | 11.00% | 44,190 | 23,303 | 16,369 | 12,922 | 10,871 |

| 10 lakhs | 10.50% | 88,148 | 46,376 | 32,502 | 25,603 | 21,493 |

To apply for a personal loan online, you must follow these steps after logging into the site and clicking the "Personal Loan" button on the home page:

Step 1: Enter your details such as occupation, current city, monthly income, mobile phone number, as well as the required loan amount, and click "Continue".

Step two. To find the most suitable personal loan offer, enter your company name, work experience, current loan EMI amount (if applicable), and PAN.

Step 3. A list of personal loan offers from various banks and non-profit finance companies for which you are eligible based on approval opportunities will be displayed. Select the loan offer that best suits your requirements and fill in any additional details that may be necessary.

Step 4. Get instant conditional electronic approval from the lender. In addition, our team will guide you through the documentation process required for the processing and disbursement of the loan.

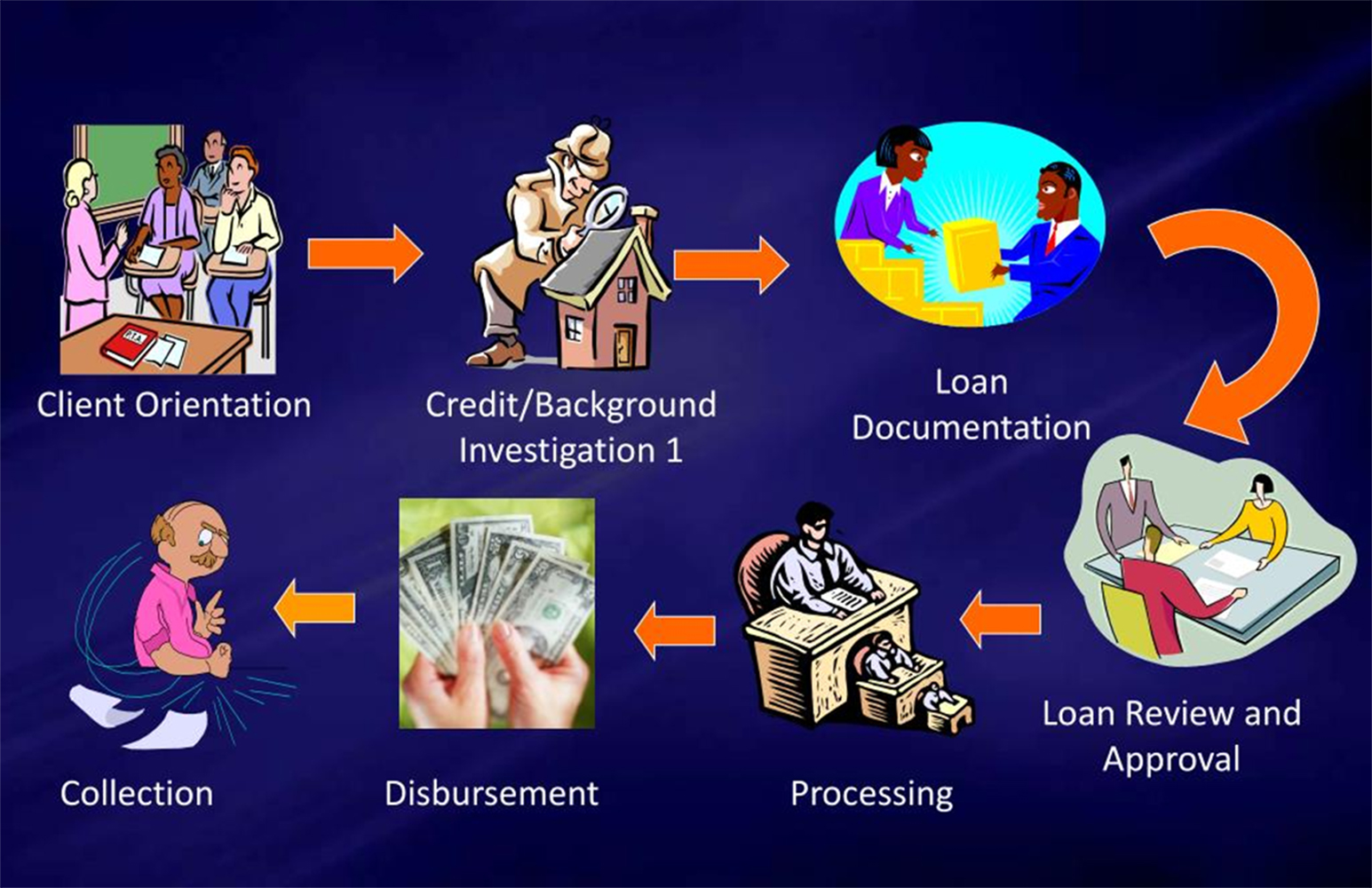

The loan verification process for a personal loan have the following key steps:

Step 1: Once you submit your application online at eFinance Advice, the chosen lender will receive the loan application online.

Step 2: Then a representative of a lender will contact you to verify the details of the application and arrange for the receipt of the necessary documents for your loan application.

Step 3: Once the documents are successfully collected and verified, the personal loan application is approved.

Step 4: The loan is disbursed once the applicant signs the loan agreement.

Once your personal loan application is approved and the loan is sanctioned, the disbursement is made in one of two ways:

First choice. Direct transfer of funds to a savings account / checking account specified by the applicant

Option 2. A paid check / money order has been sent to the applicant's postal address. for

Currently, the first option is used more popularly as the disbursement is faster and there is no risk of losing the check / bill of exchange during postal transport.

If you find it difficult to keep up with your monthly loan payments, you may be able to negotiate lower monthly payments by extending your repayment period. However, you should bear in mind that in this case, due to the longer term, you will end up paying more interest during the term of the loan. The alternative way is to opt for an personal loan balance transfer. In this case, the principal amount owed on your current loan is transferred to a new lender at a lower interest rate. As a result of the lower interest rate, individual EMI payments will decrease.

The main factors that affect the exchange limits for personal loans include the following:

Applicant income: a higher income level tends to increase the amount of disbursement

Current EMI Payment: Higher EMI Payments Typically Lower Out-of-Pocket Amount

Number of dependents: a greater number of dependents usually translates into a lower outlay amount

The list of factors that affect the exchange limits for personal loans mentioned above is not exhaustive and there may be other factors that influence the exchange decision that lenders make.

Timely EMI payments for your personal loan are essential to ensure that a clean credit history and good credit rating are maintained. There are several ways you can pay off your EMI loan:

Permanent help: You can use the NACH command to configure permanent help.

Automatic payment: You can use online banking to set up automatic payment for EMI payment.

Online Transfer: EMI payments can be made over the Internet with NEFT, RTGS and IMPS payments.

Check / Bill of Exchange: Post-dated checks (PDC) or money orders can also be used for PL EMI payment.

The following are a few specific terms related to personal loans that you must know:

Personal loan for women: is a special category of personal loans offered by various new banks and finance companies for women. In such cases, a preferential rate of interest is applied to promote and support women entrepreneurs and workers.

Retiree Personal Loan: It is offered to seniors so that they can cover their retirement needs, medical expenses or plan a trip without any financial restriction.

Pre-approved personal loan: This is a special class of personal loans, also known as instant personal loans. Usually they offered to existing customers like (account holders / credit card holders) of the bank or NBFC. Instant personal loans are characterized by minimal or no documentation, as well as quick disbursement of the loan amount (usually within a few hours). However, the loan amount approved for quick personal loan offers depends on the profile of the applicant and cannot be changed.

Supplemental Loan: is a personal loan made to a borrower who already has an unpaid personal loan from the current lender. Additional personal loans are usually available to select NBFC PL clients and often carry an interest rate similar to the standard personal loan rate.

Balance Transfer: Balance Transfer is the process whereby the principal amount owed on an existing loan is transferred to a new lender offering a lower interest rate. This reduces the total interest payments over the life of the loan.

Equal Monthly Installments: Scheduled Monthly Installments (EMI) are scheduled monthly payments that a borrower must make during the life of the loan to pay off the amount borrowed with interest owed.

Partial prepayment: In the event the borrower decides to repay a loan amount greater than the monthly EMI repayment, the additional amount is considered a partial prepayment. This partial prepayment reduces the outstanding principal on the loan and actually reduces the total interest expense on the loan. In such cases, prepayment penalties and related taxes may apply.

In addition to the interest rate, some additional fees may apply to the personal loan. Here are some of the most popular to consider:

Processing Fees – This is a fee to cover the administrative fees related to the disbursement of a personal loan. Processing fees typically range from 1% to 3% of the approved loan amount.

Prepayment/Foreclosure Charges – When an amount is made that exceeds the standard EMI payment, it is counted as a prepayment on the loan. In the event that the outstanding loan is paid before the end of its term, the process is called closing the mortgage or full prepayment. In most cases, lenders will charge a fee known as a foreclosure fee at the time this full prepayment is made. Prepayment / foreclosure fees typically range from zero to 5% of the prepaid principal plus applicable taxes plus outstanding principal.

Late Payment Charges – These fees are charged when the borrower delays EMI payments. Usually this is a flat fee that the borrower must pay out of the amount owed.

Cheque Bounce Charges – If the EMI payment is not made because the account associated with the post-dated check is low on funds or the account is closed, the return check fee will apply. This is generally applied as a flat fee of around Rs. 500.

Q1. Why any one need to apply for the personal loan?

You must apply for a personal loan for the following reasons:

Q2. What is the minimum salary required to get the Personal Loan?

The minimum monthly salary required to take advantage of a personal loan varies from one lender to another. However, it generally ranges from Rs. 15,000 to Rs. 25,000 per month.

Q3. What is the best credit score or CIBIL score for a personal loan?

Thecredit score is a 3-digit number and the range is from 300 to 900. It serves as a measure of a person's creditworthiness and financial health. Therefore, the higher the credit score, the greater the chances that a personal loan will be approved. In general, a credit rating of 750 or higher is considered good. You can improve your credit score by paying your credit card bills on time, reducing your debt, and keeping old credit card accounts in good standing. for

More information about: CIBIL personal loan points

Q4. What role do credit history and scores play in obtaining a personal loan?

Your credit history and credit score reflect how you have managed credit in the past. Therefore, it not only affects the chances of a personal loan being approved, but also the interest rate. The higher your credit score, the better your chances of being approved and receiving a lower prime rate.

Q5. Can I apply for the personal loan as a retiree if I have a pension account with a leading bank in India?

Yes, you can get a personal loan even if you are a retiree, if you have a pension account with a leading bank. However, you must ensure that your bank offers personal loans to pensioners and that it meets the eligibility criteria specified by the potential lender.

Q6. Is student can apply for a personal loan?

In general, students are not eligible for a personal loan as a constant source of income and a good credit score is a necessary prerequisite. However, if you have a stable monthly income and meet other lender eligibility criteria, you can easily take advantage of a personal loan.

Q7. Tell me what is the lowest credit score for a personal loan?

It totally depends on the eligibility criteria which was set by the lender. Most lenders do not set a minimum credit score for a personal loan. Some lenders may lend money to applicants who have a low credit score (less than 750), but the interest rate charged is usually higher in such cases.

Q8. Can I able to apply for the personal loan if I have a home loan?

Yes, any one can apply for a personal loan even you already have a home loan. However, the chances of the loan being approved will depend on your ability to repay, which in turn depends on your monthly income and credit score.

Q9. Can self-employed workers apply for a personal loan in India?

Yes, the self-employed such as businessmen, doctors, public accountants, etc. They can apply for a personal loan in India as long as they meet the eligibility criteria. More over, some banks and non-banking financial companies offer special personal loan offers for doctors, public accountants, and entrepreneurs.

Q10. Can I get a personal loan without a payroll?

Yes, you can get a personal loan without providing payroll. You can provide your bank statement / copy of Form 16 / employee certification from your employer, etc. as Salary proof to meet the eligibility criteria. However, it is always recommended to confirm the list of required documents with the lender, as it may differ from bank to bank.

Q11. Can I use a personal loan to get married?

Yes, you can take advantage of a personal loan to cover your marriage-related expenses, as personal loans have a flexible end use. Some lenders even offer personal loans with specific names for wedding or marriage loans.

P12. Can I get a personal loan from two different banks at the same time?

Yes, you can benefit from a personal loan from two different lenders at the same time. However, doing so is not recommended as it will not only affect your credit score, it will also increase your EMI payments. It would be better to take one personal loan for a larger amount than two personal loans for small amounts. In this way, you can pay lower EMIs over a longer period and improve your credit score. Plus, it will save you processing fees and other loan-related fees.

P13. What is better, a personal loan or a credit card?

Both a personal loan and a credit card are a way to borrow money. Which is better depends on the purpose of borrowing the money. If you need to borrow a fixed amount for a specific period of time, look for a personal loan. On the other hand, if you want lifetime revolving credit, look for a credit card. for

More information about: credit card versus personal loan

P14. Is it okay to pay off credit card debt with a personal loan?

Yes, paying credit card fees with the help of a personal loan is usually a good idea as follows:

P15. What is the difference between a reducing balance rate and a fixed interest rate?

In the case of the declining balance method, interest is applied to the outstanding balance of the loan, that is, to the balance due after reducing it by the principal amount paid. As a result, the cost of interest continues to decline over the life of the loan. On the other hand, a fixed interest rate is calculated on the total loan balance during the life of the loan. Therefore, the interest payable does not decrease during the term of the loan.

P16. Do I always have to choose the lowest possible equal monthly amount before accepting a personal loan offer?

Lower EMI offers are the result of a lower interest rate or a longer repayment period, and sometimes both. Therefore, before choosing a personal loan offer, you should consider both the interest rate and the term of the loan. A lender offering the lowest EMI will likely deliver the longest period, which in turn can increase your total interest payments. On the other hand, an equal monthly personal loan offer may be comparatively higher, but for a shorter period actually cheaper in terms of total interest paid. Therefore, you should always calculate your total interest payments and also consider your ability to repay before choosing a specific loan offer.

Q1: What documents are required to apply for a personal loan?

The documents required to take advantage of a personal loan vary from one lender to another. However, most banks and non-bank financial companies require proof of identity, proof of address, and proof of income.

Q2. How do I choose the best personal loan offer?

With so many personal loan offers available, choosing the best one can be difficult for some people. But don't worry and follow these tips to choose the best personal loan offer:

Q1. What happen if someone don’t pay the EMI?

Losing a single EMI might not have a major impact on your credit score, but losing multiple monthly installments will happen. Repeated failure will not only affect your credit score, but it will also add to your debt.In rare cases, the lender may send initial notifications indicating the outstanding loan amount and penalty fees. The bank can also initiate legal proceedings or communicate with the guarantor (if applicable).

Q2. What are the benefit and disadvantage of personal loan balance transfer?

It may happen that you take out a personal loan at a higher interest rate because you need the funds right away. However, you will later discover that other lenders are offering a lower interest rate. In such a situation, transferring the personal loan balance is the most effective way to relieve the burden. Let's look at the pros and cons of a balance transfer to help you make an informed decision:

Q4. What does this terms "settlement, default and closed" mean with respect to a personal loan?

You may come across terms like settlement of loan, default or closed with respect to your old or current loans/ credit cards while going through your credit report. These terms are in fact not specific to a personal loan and their meanings are as follows:

Settlement: This means that you were unable to pay off the loan amount. As a result you and lender set an agreement to pay only a portion of your dues instead of paying entire outstanding amount. As much as 30% to 40% of your outstanding loan may be waived off by the lender as part of the settlement process.

Default: Means that you have not pay your loan, i.e., you have not paid your pending loan. More over, you and the lender were unable to come to an agreement related to the outstanding dues. This is the bad possible outcome of taking a loan as it directly impacts on your credit score severely and most lenders will assume you a risky borrower in the future.

Closed: Closed means that applicant have successfully paid the loan. A successfully closed loan account helps maintain a good credit score and represents you as a low risk borrower to prospective lenders.

Q5. What is prepayment means and are banks charges any amount for it?

When a reture the loan amount before the due date, is called prepayment. Yes, many banks and NBFCs charge a prepayment fee ranging from 1% to 5% on the outstanding principal amount of the loan.

Q6. What does partial subscription and foreclosure mean?

Partial repayment or partial early repayment means when you repay part of the loan amount in advance, while seizure is a condition when you repay the loan amount in full before the due date.

Q7. What are the benefits of subscribing and seizing work?

Despite the associated costs, loan repayment is an economically viable option. If you repay / borrow the loan in full in advance, you save significantly on interest components. In addition, your outstanding debt is reduced.

On the other hand, if you are partially paying off the loan amount, you may decide to reduce your EMI disbursement or loan. Moreover, repayment of the deed also helps you save on interest components and reduce the remaining debt.

Q8. Can I cancel the personal loan after the loan amount is processed?

In some of the cases, you can cancel a personal loan after disbursal it is totally a subject of banks terms and conditions of the lender. Loan cancellation will lead some charges and the processing fee. Note that all banks are not allowing loan cancellation once the amount is disbursed or credited in your account. However, you can always prepay the loan amount as per the terms and conditions of the bank and save on the interest component.

Q9. What is a top up loan?

Top-up loan means the second personal loan that you can get over an existing personal loan. The second loan can either be used to consolidate debt or to meet a new requirement.

Q10. Is personal loan taxable?

No. need not to pay additional tax if took a personal loan. In fact the interest payable on a personal loan may be eligible for tax deduction u/s 24b if you use the loan proceeds for the purpose of home remodeling/renovation.

Q11. Is it possible to transfer personal loan to another person?

Under current regulations it is not possible to transfer your personal loan to another person. However, some lenders do have the option of having a co-borrower/guarantor for a personal loan and in such cases, the co-borrower/guarantor will be required to repay the loan in case the primary borrower defaults!