A home loan is a certain amount of money that a person has borrowed from a financial institution to buy or build a house. Housing loans can also be used to expand, repair and renovate existing property. A housing loan is a type of secured loan, in which the purchased property is mortgaged by a bank or a lending institution until the borrowed amount is repaid with interest. In India, mortgage interest rates start at 6.80% per annum, and loan terms are extended to 30 years.

For many people, buying a home can be a difficult task due to high property prices or lack of excess liquidity. Therefore, a home loan can help you make that big financial step without breaking your savings and investing. Home loans have a number of benefits and features, including a balance transfer service, a free loan, flexible payment options and quick approvals.

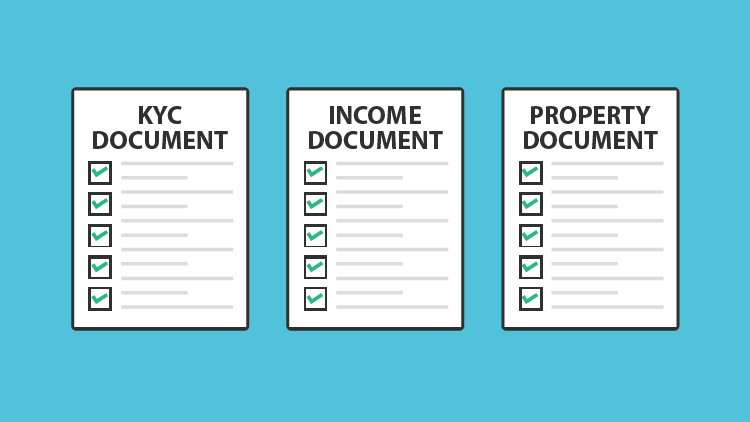

The documents required for a mortgage application are almost identical to those of different banks, local financial institutions (HFCs) and other credit institutions. The number of special requirements may vary from donor to provider. The documents required for a mortgage can also vary depending on your loan plan, the purpose of the loan, the status of each loan, and so on. Below is a list of standard loan documents that a borrower can apply for when applying for a loan.

The list of documents required to apply for a mortgage is as follows:

1. PAN Card

2. Passport

3. Aadhaar Card

4. Voter’s ID Card

5. Driving License

1. Aadhaar Card

2. PAN Card

3. Passport

4. Birth Certificate

5. 10th Class Marksheet

6. Bank Passbook

7. Driving License

1. Bank Passbook

2. Voter’s ID

3. Ration Card

4. Passport

5. Utility bills (Telephone Bill, Electricity Bill, Water Bill, Gas Bill)

6. LIC Policy Receipt

7. Letter from a recognized public authority verifying the customer’s address

For Salaried Individuals:

1. Form 16

2. Certified letter from Employer

3. Payslip of last 2 months

4. Increment or Promotion letter

5. IT returns of past 3 years

6. Apart from the income proof the salary person, need to give any investment proofs (like fixed deposits, shares, etc) and his passport-size photographs.

1. Income Tax Returns (ITR) of last 3 years

2. Balance Sheet & Profit & Loss Account Statement of the Company or the Firm (duly attested by a C.A.)

3. Business License Details (or any other equivalent document)

4. The license of Professional Practice (For Doctors, Consultants, etc.)

5. Registration Certificate of Establishment (For Shops, Factories & Other Establishments)

6. Proof of Business Address

1. NOC from Society/Builder

2. A detailed estimate of the cost of construction of the house

3. Registered Sale Deed, Allotment Letter or Stamped Agreement of Sale with the Builder (original document)

4. Occupancy Certificate (in case of ready-to-move-in properties)

5. Property Tax Receipts, Maintenance Bills and Electricity Bills

6. Receipts of the advance payments made towards the purchase of flat (original document)

7. An approved copy of the building plan (key plan/floor plan in case of purchase of flats)

8. Original of the land tax paid receipt and possession certificate as issued by the revenue authority

9. Payment receipt or bank account statements showing payments made to the Builder or Seller

In addition to the interest rate, there are fees and other fees that your lender may charge from the time you apply for a home loan until it is paid in full. Here are the fees:

Application Fee : All basic costs incurred by creditors during the verification are charged.

Processing Fee: It covers the cost of debt identification based on the debtor's status, his income and the mortgage scheme. All lenders do not charge a service charge.

Administrative Fee: The bank charges a service fee in two type. The part that is paid after getting a loan is called an administration fee. Citibank is one of the banks that charge administration fees.

Franking Fee : This is commonly tell as stamp duty fee, is a tax levied by the state government on any form of monetary transaction involving the transfer of rights of a property.

Preclosure/Prepayment Charges of home loan : They are collected when the lender repays the housing loan in whole or in part before the end of his tenure. Previously, creditors used to pay fines for early repayment and closing on a housing loan. However, the RBI has prohibited creditors from levying individuals fines for early repayment of floating rate loans. For fixed rate housing loans, some lenders charge these fees.

Fees related to the repayment scheme: Charged when borrowers ask their creditors to change their existing repayment scheme for the duration of the loan. The fee is usually increased to Rs. 500 per instance (exchange) and varies from one creditor to another.

Conversion fees / exchange fees: They are charged when, for various reasons, lenders ask their creditors to change or lower their current interest rates. The fee varies from one creditor to another and usually represents up to 2% of the principal amount due.

CERSAI (Central Reconstruction Assets and Guarantees) Fees: This is the central register of online security interests in India. Prospective creditors visit the CERSAI website and check that the mortgage property is not requested by another creditor. For this process, creditors pay a nominal fee, which they later collect from the debtors.

Late EMI Fees: Charged when the lender loses or delays timely payment of an EMI loan. It attracts penalized interest rates due to installments due or overdue over the overall loan interest rates. Therefore, lenders must pay the EMI loans on time.

EMI withholding fees: They are charged when you fail to repay a loan in a timely manner due to a lack of funds in your bank account. Lenders usually choose Rs. 500 to such default values which may vary from one creditor to another.

Legal fee: It is usually included in the processing fee, but some creditors charge it separately when participating in companies to review debtors' legal documents.

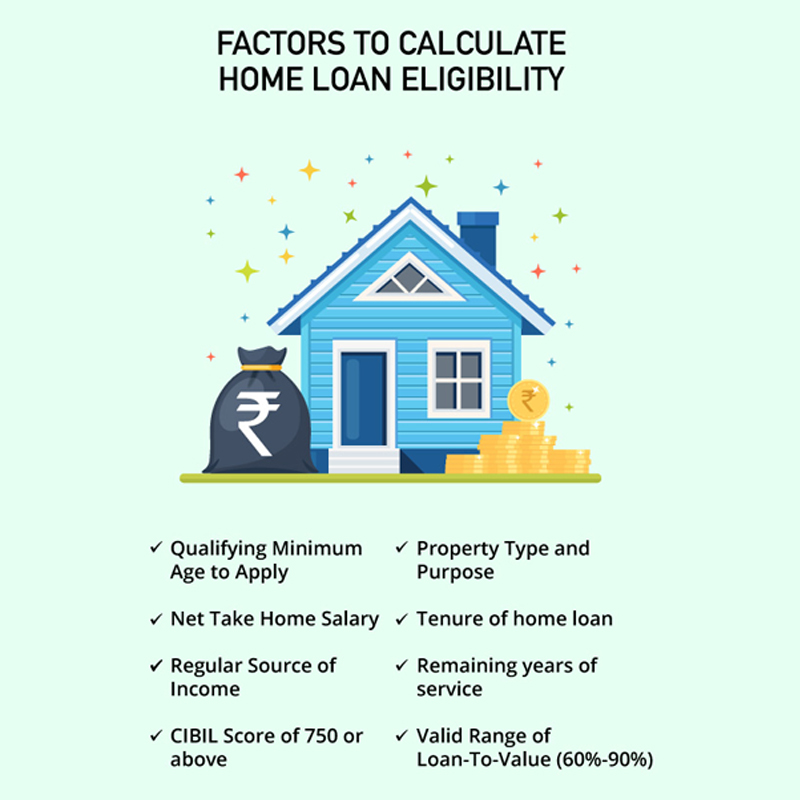

| Home Loan Eligibility Criteria | |

|---|---|

| Nationality | Indian Residents, Non Indian Residents (NRIs) and Persons of Indian Origin (PIOs |

| Credit Score | 750 or above |

| Age Limit | Minimum – 18 years Maximum – 70 years |

| Work Experience | At least 2 years |

| Business Continuity | At least 3 years |

| Minimum Salary | At least Rs. 25,000 per month (varies across lenders & locations) |

| Loan-to-Value (LTV) Ratio | Up to 90% of property’s value |

Note: The Values In On The Table May different From One Bank To Another.Ways To Enhance Home Loan Eligibility

Improving your credit score: A good credit score increases your chances of approving a loan so you can take out a home loan at lower interest rates and better terms. Paying bills on time and keeping your credit utilization ratio below 40% are some of the ways to improve and maintain your credit score.

Paying down payments: Financial institutions borrow 75-90% of the value of the property. This means that the lender has to deposit the remaining 10-25% of the property value as a deposit. To increase home loan eligibility, contribute a higher amount to the lower payment on the home loan. Doing so will reduce your LTV ratio; thereby enhancing the possibility of a home loan.

Add joint applicant for earnings: Add joint applicant for earnings with good credit history and satisfactory repayment ability to increase home loan eligibility. A joint home loan can even help you get a higher loan amount and a reduction in home loan interest rates (if the co-applicant is female).

Transferring the balance to a home loan is a device that allows home loan lenders to transfer their outstanding home loan to a new lender at a lower interest rate or better loan terms. Almost all lenders offer their customers the tools to transfer housing loans. Regular repayment of the EMI loan is one of the factors that will help you use the loan transfer. However, before moving to a home loan balance, do a cost-benefit analysis. Calculate the difference between the interest rates offered by the two creditors, the amount of loan outstanding and the outstanding holding.

Transferring the balance to a home loan is not an ideal choice if the amount of the loan outstanding is low, there are only a few years of repayment left, or the interest rate difference leading to negligible savings. Also, make sure you consider the processing fees that the new creditor would charge to transfer the balance.

Home loan prepayment is when a lender partially repays their home loan before the end of their term of office. The loan prepaid helps reduce the principal amount of the loan, which in turn reduces the amount of EMI. If the lender does not find it difficult to continue with the amount of the impending EMI, he may, instead of reducing the EMI credit, ask his creditor to reduce his possession of the loan.

Home loan blocking , on the other hand, is when a borrower repays a home loan in one installment instead of pre-loan installments. Previously, lenders charged fines for early repayment of a loan and fees for blocking access to floating rate housing loans. However, RBI has now instructed all lenders not to insist that loan and early repayment fees expire when individuals take out a loan before closing for floating rate loans. However, some fixed rate lending providers still charge these charges.

Interest rate: Some housing lenders charge a fixed rate and a floating rate part for housing loans. Fixed interest rates are considered ideal for loans with shorter maturities, while a floating interest rate is suitable for loans with shorter maturities. Some lenders even offer hybrid home loans where the lender can take advantage of fixed and floating interest rates.

Loan payment time: Loan payment time varies by bank. It usually takes about 10-15 days to process and repay the loan. Choose a home loan provider that takes less time and does not cause unnecessary delays in getting a home loan.

Loan eligibility: Eligibility criteria for a home loan vary from provider to provider. The normal eligibility of a home loan to an individual is determined by the borrower's age, income, job profile and stability, credit history, etc. Always use a home loan eligibility calculator to determine whether or not you qualify for a home loan.

Hidden fees: Lenders charge several additional fees, such as a processing fee, prepayment fee, or account closing fee, and more. Before the last resort, it is best to read the fine print so that you do not feel out of your pocket when collecting such fees.

Terms: When choosing a home loan, you should also consider a list of repayment, early repayment, loan transfer and many other loan related terms home.

Question: Can I get a home loan in the full value of the property?

Answers: No. Banks usually keep a 20% margin when providing housing loans to individuals. This means that the lender can agree to provide you with 80% of the value of the property as a home loan, while you have to pay the remaining 20% yourself. In some cases, the lender may agree to provide you with up to 90% of the value of the property as a home loan.

Question: Are there any tax benefits on a home loan?

Answers: Yes. The amount of loan principal and interest paid on repayment of the loan provides tax benefits under Sections 80C and 24 of the IT Act.

Question: Who can sign a home loan with me? Can my friend sign a home loan?

Answers: Your family members, such as father, mother, siblings, etc., can sign a home loan with you. In addition, your spouse or adult children can also be signatories if you apply for a housing loan. In India, under current rules, your friend cannot sign a loan because it is not a blood relative or otherwise has a relationship with you.

Question: How many people can sign a home loan with me?

Answers: Currently, up to 7 people can sign home with a lead candidate. However, everyone must be blood relatives of a family member.

Question: Are there any early repayment fees for a home loan?

Answer: In the case of a floating rate home loan, creditors do not charge a fine for prepayment under RBI guidelines, but in the case of early repayment of a fixed rate home loan, the fine can be used. For more information on home loans, visit the Home Loan FAQs page.

Question: How is an EMI home loan calculated?

Answers: Equal monthly payment (EMI) is the amount you repay each month against the principal amount of your home loan and the amount of its interest. So the EMI for a housing loan takes into account the amount of principal and interest accrued on the loan.

Q: How do I use an EMI calculator to rent a house?

Answers: The EMI Home Loan Calculator is an effective tool for comparing the different loan options available to you from different banks and financial institutions. You can use an EMI calculator for a home loan. You only need to provide a few details, such as the loan amount, interest rate, and holding a home loan.

Question: What are the important points to remember when choosing a home loan?

Answers:

A housing loan is a long-term commitment that must be fulfilled. When choosing a home loan in India online you should always be aware and keep the following points in mind:

Question: What are the reasons for refusing a home loan?

Answers: Factors that can play a decisive role in refusing a home loan are listed:

Q: How to avoid refusing a home loan?

Answers: The following steps may be useful if you want to avoid refusing a home loan to you:

Q: Can NRIs take home loan?

Ans: Yes, NRI can apply for home loan. for more details visit NRI home loan page.