Blog!

What factors can affect your home loan eligibility?

If you look forward to buying an ideal home, you might consider using a home loan that meets all your requirements. Home loan viability is determined by factors such as low interest rates, flexible repayment options, minimum formalities and quick payouts. It is important that you study all the features of your home loan before you decide. Before applying for a home loan, you should check the eligibility of your home loan using the online loan eligibility calculator. This allows you to better understand whether to use a home loan from that particular lender. Here are some of the main factors that determine the eligibility of your home loan.

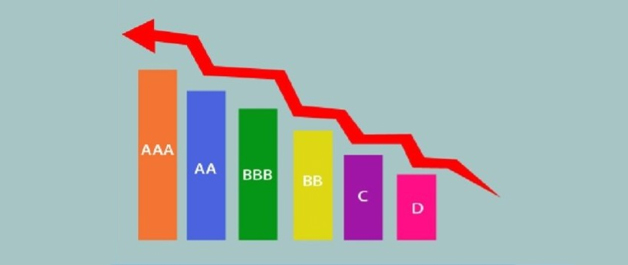

Credit Rating

Because your credit score determines your credit worthiness, it plays a vital role in determining whether your home loan qualifies. A high credit score will reflect your high ability to repay and increase your home loan eligibility. Therefore, it is important that you maintain a good credit history. You can improve your credit score by repaying your outstanding debts and making timely payments to your other EMIs. Double-check your credit score and ask for a dispute if you find any credit score errors.

Annual income

Financial institutions control your annual income and set a maximum home loan you can use. Therefore, you should ensure that you have a regular income, stable funding and better earning potential in the future. If you have other sources of income, you should provide accurate information about the same. Also keep a record of salary components that are variable in nature. All of these things will help you increase the eligibility of your home loan.

Your age

Your possession of a home loan depends largely on your age. The higher your work experience, the better your chances of approving a home loan. Because holding your home loan can only reach retirement age, creditors will indicate your age before approving the loan application.

Age of property

The maximum eligibility of a home loan will depend on the age and value of your property. Most lenders have a ceiling for the upper age of the building. Therefore, if you are buying a property for resale, the likelihood of acquiring a higher credit holding is very low. This in turn reduces the loan eligibility.

Challenge and set achievable goals

It is possible to become a successful daily trader with a challenging schedule. All it takes is discipline and patience. Continued understanding of how markets work requires persistence and time. It would also take some time to decide on the appropriate business plan based on your schedule and personality. Here it is important that you face the challenge of setting goals and achieving them. The price is that one day you will be able to earn a living from trading.

Equipment agreement

Some buyers enter into an equipment agreement to reduce the payment of stamp duty applicable to the transfer of assets. However, such transactions have a direct impact on the loans that lenders are prepared to provide. It should be noted that the eligibility criteria for housing loans may vary between creditors. Therefore, it is important that you check your eligibility before applying for a home loan The basic eligibility criteria for housing loans are listed below: You must be an Indian citizen You must be paid by a person with at least 3 years work experience. Paid persons aged 23 to 62 are entitled to a home loan. The amount of housing loan you can apply for ranges from 10lakh to 3.5 Kr. You can calculate your home loan eligibility using the Home Loan Calculator by following these steps:

Step 1: Identify if you have additional monthly income sources

Step 2: Specify the amount of current EMI or liabilities

Step 3: Enter your city of residence

Step 4: Enter the date of birth

Step 5: Enter your net monthly salary

Step 6: Remove the loan holding

Click Calculate your eligibility to calculate your eligibility for a home loan. The amount of housing loan and loan payment is given for accounting purposes. Finally, it is important that you understand the terms and conditions carefully before taking out a home loan.